Key Takeaway

- Direct Impact on Profitability: Every dollar leaked is a dollar subtracted from your bottom line. With profit margins already under pressure in many industries, even small percentage leakages can significantly impact overall profitability.

- Compounds Over Time: Unlike one-time losses, revenue leakage tends to be systemic and recurring. A 3% leakage rate doesn't just mean losing 3% this month—it means losing 3% every month until the issue is fixed.

- Distorts Business Intelligence: When revenue isn't properly tracked, your business metrics become unreliable. This can lead to poor strategic decisions based on inaccurate data.

- Affects Customer Relationships: Billing errors and inconsistencies can damage customer trust and satisfaction, potentially leading to higher churn rates.

- Creates Competitive Disadvantage: Companies that effectively prevent revenue leakage have more resources to invest in growth, innovation, and customer experience than those who don't.

There’s a good chance you’re leaving money on the table—lots of it, too. Like thousands of other businesses, your organization may be experiencing revenue leakage. The challenging part? It’s hard to tell when and where the leak happens.

Most pipeline reviews don’t reveal what’s happening or if you’re losing money each month. Even worse, most businesses don’t know how to fix leaks when they are eventually discovered.

According to research from EY, companies lose up to 5% of their earnings annually due to revenue leakage. That’s a substantial portion of revenue that directly impacts your bottom line. For a company with $10 million in annual revenue, that’s $500,000 silently disappearing each year.

In this article, we’ll explain what revenue leakage is, why it happens, how to spot it, and most importantly, how to eliminate it before it seriously damages your business. So, if you’ve ever wondered “what is revenue leakage?” or suspect that your revenue may be leaking, keep reading.

What is revenue leakage?

Revenue leakage refers to the loss of revenue from your business that often goes unnoticed. It represents money that your organization has earned or should have collected but hasn’t—essentially, the gap between what customers should pay and what you actually collect.

Think of revenue leakage as water leaking from a pipe: money that should have been earned simply slips away. Unlike deliberate business decisions like strategic discounts or planned price reductions, revenue leakage is unintentional revenue that a business fails to capture, record, or collect that it has rightfully earned.

Key Characteristics of Revenue Leakage

Revenue leakage manifests in several important ways:

- Uncollected earnings: Money from customers that remains unpaid despite services being rendered or products being delivered

- Billing discrepancies: Services delivered but not invoiced, or products given away without proper documentation

- Pricing oversights: Products sold without charging for certain features due to oversight or system errors

- Unrecovered costs: Work performed that doesn’t make it into the invoice

There are several reasons revenue leaks may happen, and the causes vary from one business to the other. But the impact is typically the same — stunted growth, revenue loss, and missed quotas. Even worse, it is near-impossible to spot revenue leaks, especially if your business still leverages manual processes.

What does revenue leakage mean for your business?

According to an MGI research, an estimated 42% of companies experience some form of revenue leakage, and further research conducted by EY suggests that every company loses 1% to 5% of realized EBITA to leakage annually.

Revenue leakage is bad news for any business, especially businesses looking to grow. This unintended loss of revenue can impact the bottom line considerably. Because factors causing revenue leaks differ based on each organization’s structure, it can be challenging to determine the exact cause of leaks across the board.

The visibility problem makes revenue leakage particularly dangerous. The disparity in financial reporting caused by missing revenue skews margins and impacts strategic business decisions, potentially misleading leadership about company performance. For businesses with complex billing systems like those using NetSuite or Chargebee, these issues can be even more difficult to detect.

Many forward-looking organizations have started replacing manual aspects of their processes with robust AI-based revenue intelligence solutions, making it less challenging to spot leaks.

What causes revenue leakage?

The first step toward eliminating unintended revenue loss is by identifying what caused the leaks in the first place. Revenue leakage stems from two fundamental sources: faulty processes and bad data. Understanding these root causes is essential for developing effective prevention strategies.

Inaccurate or Incomplete Data

If your organization still manually collects and saves data, this might be the biggest cause of leaks in your pipeline. The problem with manual data entry is that it is highly error-prone, and a single error can cost you thousands in revenue.

This is especially the case for organizations that have a large customer base and have to deal with a lot of customer data. In such cases, it is best to invest in a data automation tool, to reduce errors and ensure that your reps are not making any mistakes.

Poor data quality creates systematic problems throughout the revenue cycle:

- Inaccurate billing information: Incorrect customer data, pricing records, or contract terms

- Manual data entry errors: Typos and mistakes in transferring information between systems

- Lack of data synchronization: Different departments maintaining conflicting records

Errors in Data Synchronization

Imagine this: Customer A subscribes to the basic plan of your product and is billed $10 per month for the service. After a month, Customer A upgrades to the premium plan which costs $60 per month. But, here’s the problem, your account manager forgot to make an update to their subscription plan pricing. The result – revenue leaks.

When data is incorrectly synced or not synced at all, you end up losing revenue without even realizing it’s happening. The more data synchronization errors you have, the more pronounced the leaks and their impact on your business.

This is particularly common in businesses using multiple systems like Salesforce, Stripe, and DealHub that don’t properly integrate with each other.

Flawed Engagement with Customers

With how notoriously busy reps are, it can be all too easy for them to miss sending an invoice to a customer, especially when dealing with a large customer base. When this happens, the chances the customer will request the invoice themselves are pretty slim.

Without an automated system that helps your reps engage efficiently and track billing cycles, you may be losing revenue as well as potential upsells at the same time.

Limited Pipeline Visibility

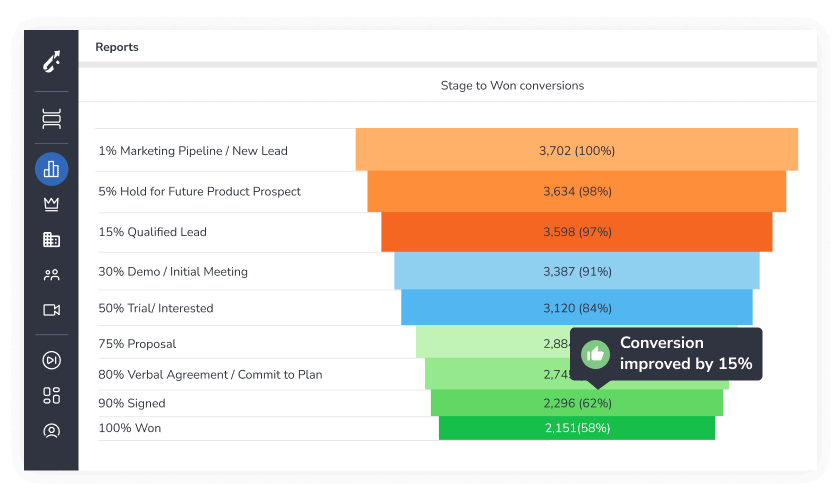

If you and your team have limited or no pipeline visibility, it can be very difficult to see what’s happening in your pipeline and if revenue is leaking out. Without visibility, you can’t tell when or why deals go south, why customer engagement is stalling, and so on; all of which contribute in one way or the other to revenue leaks.

This is usually the case for businesses that do not have a centralized data bank that allows for generating insights and reports or businesses that still manually handle data.

Limited Selling Time

According to Salesforce, reps only spend about 34% of their time on selling-related activities. This means a good 66% of their productive time is spent doing administrative tasks that could easily be automated to save time and money. Every time your reps spend not selling equates to lost revenue.

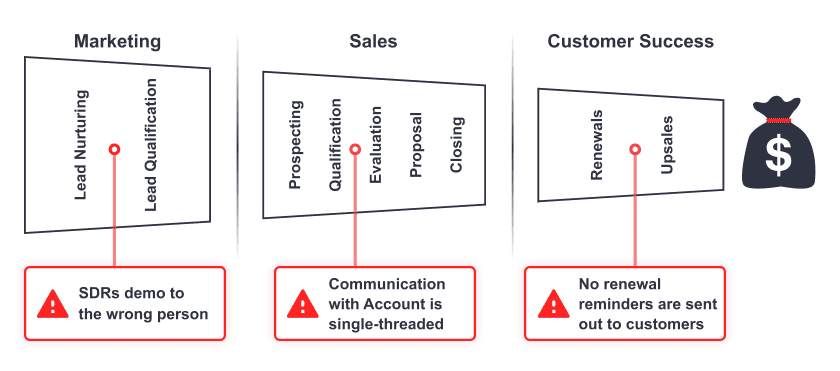

Other factors that cause revenue leaks include but are not limited to:

- Inaccurate forecasting

- Inconsistent revenue engine execution process

- Misalignment between teams

- Slow movement of deals across your pipeline, etc.

Industry and Transaction Type Factors

Revenue leakage is much more common in transactions involving contracts or ongoing customer relationships. Industries with complex billing requirements-such as telecommunications, software-as-a-service, professional services, and subscription-based businesses-face higher vulnerability to revenue leakage. Conversely, cash transactions where buyers walk away with goods immediately after payment are less prone to revenue leakage.

How to Identify Revenue Leakage

To spot leaks on time, you need to periodically scrutinize your entire sales process, from your CRM and pipeline to your team’s workflow and activities, to spot potential areas that could cause leaks.

But, this can be challenging to do manually, especially for companies with a large customer base or workforce. As such, investing in a revenue intelligence tool that can help you x-ray your entire sales process, pipeline, CRM, and workflows for potential leaks is highly recommended. But, not every solution on the market can accurately spot leaks ahead of time.

Three-Step Traditional Framework

Identifying revenue leakage requires a systematic, methodical approach that examines operations and traces where numbers don’t align. Here’s a proven framework:

Step 1: Form a Hypothesis

Begin by developing theories regarding where revenue leaks originate. This involves getting a sense of where revenue leaks tend to happen in your specific industry. Engage employees in revenue-generating positions and ask them where they suspect revenue might be slipping away—these frontline employees often have valuable insights into process breakdowns.

Step 2: Rank by Economic Value

Not every revenue leak has equal magnitude, so prioritize different leaks based on the dollars lost or uncollected. Create a ranking system that identifies which types of leaks have the biggest financial impact on your business. This prioritization ensures that resources are allocated to the highest-value opportunities first.

Step 3: Test Your Hypothesis

Verify your theories regarding revenue leaks through rigorous auditing. The audit can be conducted by the finance department with help from those responsible for revenue generation. This process should examine both data and operational problems and might include recreating steps related to specific revenue moments to pinpoint exactly where issues occur.

Key Performance Indicators to Monitor

Monitor and analyze these performance metrics that track revenue health:

- Collection rate: Percentage of billed revenue actually collected

- Days sales outstanding (DSO): Average days to collect payment after invoicing

- Billing accuracy rates: Percentage of invoices without errors

- Discount variance: Actual discounts taken versus authorized discounts

- Unbilled services: Backlog of work performed but not yet invoiced

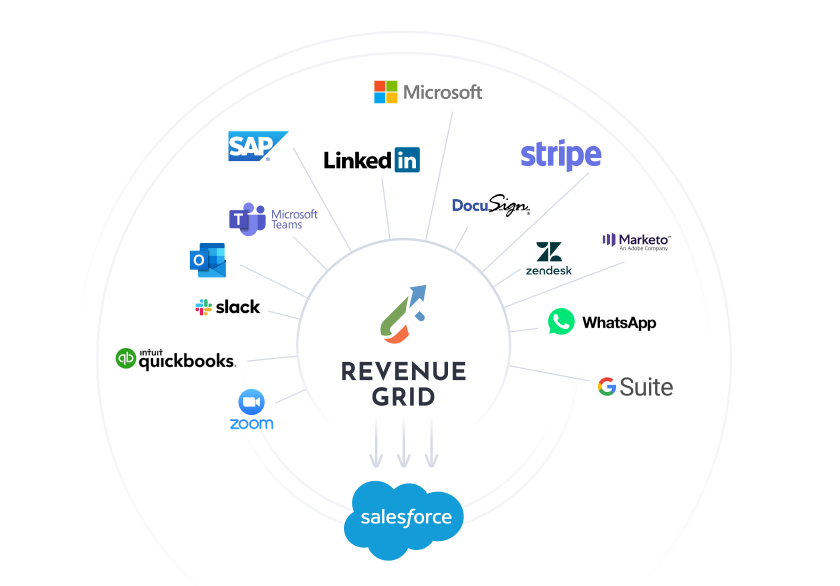

You need a Salesforce-native solution like Revenue Grid that can seamlessly integrate with your CRM and spotlight potential problem areas in your pipeline or processes where leaks may be happening (or might eventually occur). With Revenue Grid, you get real-time revenue leakage analytics, allowing you to spot leaks and their causes ahead of time and plug them, so they never happen again.

Revenue Grid also prevents leaks by automating key sales processes such as data capture, customer engagement, and conducts revenue leakage audits using data-based insights and AI. In the next section, we’ll show you how to use Revenue Grid to stop revenue leakage on time.

4 Steps to Stop Revenue Leakage

Once revenue leakage has been identified and understood, organizations can implement a structured approach to prevent and reduce ongoing losses.

1. Auto-capture All Relevant Sales Data

One of the biggest causes of revenue leaks in businesses is data entry or synchronization errors. To eliminate leaks, the first thing to do is to centralize your data in a way that allows for no errors, by automating it. Automating your data capture means you have accurate and updated data in your CRM always.

An excellent way to achieve this is by using Revenue Grid’s data capture tool, which automatically captures and saves customer data from all touchpoints (emails, calendars and communication tools) to your CRM.

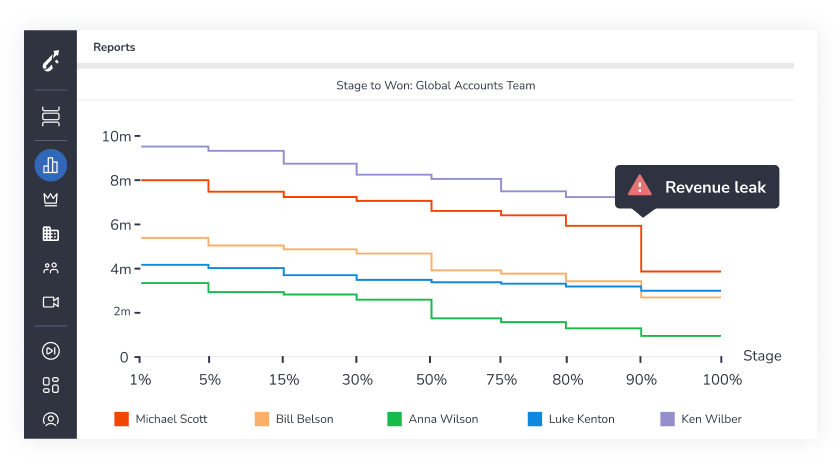

2. Analyze Data with AI

Once you’ve pooled all related sales data into a central source of truth, the next thing is to look through these collected data to spot where and why leaks may happen. But, manually sifting through hundreds or even thousands of customer data is not realistically possible and (even if it is) you might be unable to spot the problem areas. But, with a revenue intelligence tool, it should be a walk in the park. With a tool like Revenue Grid which has revenue leakage analytics, you can analyze the captured data with AI and easily spot when and where the leaks are happening and the reasons behind them.

3. Implement Company-wide Changes in the Sales Process

Once you’ve established where and why revenue leaks are happening, you can then implement company-wide structural changes that ensure your team follows the right processes every time to avoid leaks.

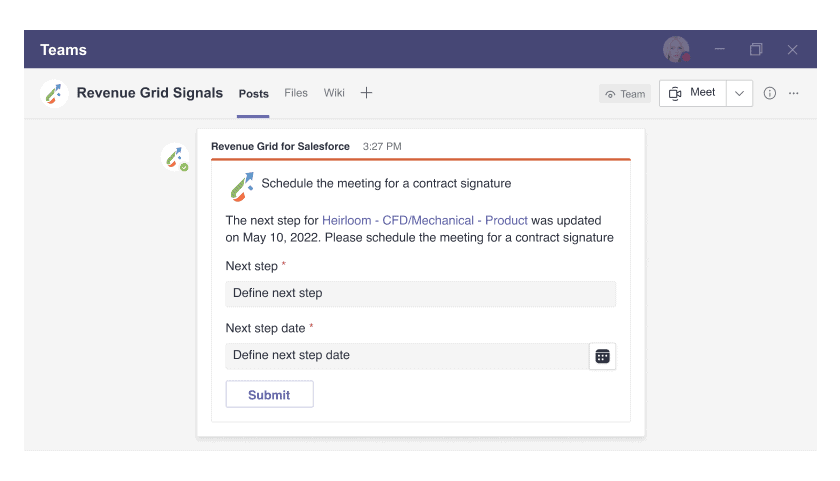

For instance, if the leaks happen because your reps forget to follow up with customers after a critical meeting, you can set up a trigger that automatically ensures your reps engage customers at specific key stages in the sales process. Revenue Signals from Revenue Grid are an excellent way to implement organizational changes to prevent leaks.

Revenue Signals from Revenue Grid are an excellent way to implement organizational changes to prevent leaks. These Signals provide real-time and contextual notifications that guide your team on the next best action at strategic points in the sales process.

Establish clear, enforceable policies that govern revenue-impacting decisions:

- Discount approval workflows: Create tiered approval systems requiring authorization from appropriate management levels before discounts are applied

- Change management processes: Implement procedures ensuring that all contract modifications, scope changes, and pricing adjustments are properly documented and reflected in billing systems

Regular policy reviews: Periodically update policies to close loopholes and address newly identified areas of leakage

4. Measure the Effectiveness of Changes

It’s not just enough to spot and fix the leak, you also have to measure the effect of fixing the leak to ensure it is successful. For instance, if your realized committed pipeline and forecast remain misaligned even after fixing the leak, then there’s a good chance that you need to iterate the entire process.

Of course, it might not be easy to measure the effect of changes made unless you use a revenue intelligence tool that can help you visualize the difference in your pipeline and processes after plugging in the leaks. Once you can tell that your revenue is improving or meeting the forecast, only then can you rest assured that you’ve fixed the leaks.

Measuring the Effectiveness of Changes

Successfully preventing revenue leakage requires the ability to measure whether prevention efforts are actually working. Without proper measurement, organizations cannot determine if their investments in prevention are yielding returns.

Key Performance Metrics to Track

Establish baseline metrics before implementing changes, then track these metrics over time to assess improvement:

Revenue Capture Metrics

- Percentage of billable items captured: Track what percentage of deliverables or billable events make it into the invoicing system

- Revenue recognition accuracy: Compare recognized revenue to actual earned revenue to identify gaps

- Billing completeness: Measure the percentage of customer invoices that include all applicable charges

Collection Metrics

- Days sales outstanding (DSO): Monitor the average time between invoicing and payment collection

- Collection rate: Track the percentage of invoiced amounts actually collected

- Aging analysis: Monitor invoices by age bracket (current, 30-60 days, 60-90 days, 90+ days) to identify collection bottlenecks

Quality and Accuracy Metrics

- Billing error rate: Track the percentage of invoices containing errors (pricing, quantity, account coding, etc.)

- Rework percentage: Measure how often invoices must be corrected after initial generation

- Customer dispute rate: Monitor the percentage of invoices disputed by customers

Financial Impact Metrics

- Revenue leakage reduction: Calculate the dollar amount and percentage of revenue leakage eliminated

- Profit margin improvement: Measure the impact on overall profitability

- Return on investment (ROI): Compare the cost of prevention initiatives to the revenue recovered

Implementation Approach

Begin by establishing clear baselines for each metric before implementing prevention measures. After changes are implemented, measure the same metrics on a regular schedule (quarterly or monthly, depending on transaction volume) to track progress. Look for trends rather than single-period results, as some improvements take time to fully manifest.

Create visual dashboards that display these metrics in easily understood formats, making it simple for leadership to understand the effectiveness of revenue leakage prevention efforts. This transparency helps maintain organizational commitment to these initiatives.

Types of Revenue Leakage

Revenue leakage comes in many forms, each requiring different detection and prevention strategies:

1. Pricing Leakage

This occurs when products or services are sold at lower-than-intended prices due to:

- Unauthorized discounts given by sales representatives

- Failure to implement price increases

- Incorrect application of volume or tiered pricing

- Outdated price lists in sales or billing systems

2. Contract Leakage

This happens when the terms negotiated in contracts aren’t properly implemented:

- Failure to bill for all contracted services

- Missing contract renewals or auto-renewal opportunities

- Not enforcing minimum purchase commitments

- Overlooking contracted price escalations

3. Process Leakage

This stems from inefficient operational processes:

- Delays between service delivery and invoicing

- Missing or incomplete documentation of billable work

- Inefficient collections processes

- Manual handoffs between departments that result in lost information

4. System Leakage

This occurs when technology systems fail to capture or process revenue properly:

- Integration gaps between CRM, ERP, and billing systems

- Data synchronization failures

- System configuration errors

- Automation failures in recurring billing

5. Compliance Leakage

This happens when regulatory requirements impact revenue collection:

- Inability to bill due to incomplete compliance documentation

- Penalties or refunds due to non-compliance

- Revenue recognition timing issues related to compliance requirements

Industry-Specific Examples of Revenue Leakage

Different industries face unique revenue leakage challenges based on their business models and operational complexities:

SaaS and Subscription Businesses

In the software-as-a-service industry, common revenue leakage points include:

- Failed subscription renewals due to expired payment methods

- Missed upsell opportunities when customers exceed usage limits

- Prolonged free trials without conversion to paid accounts

- Incorrect tier pricing applied to accounts

- Untracked API usage that should be billable

Professional Services

Service-based businesses frequently experience leakage through:

- Unbilled hours for work performed but not recorded

- Scope creep without corresponding billing adjustments

- Delayed invoicing leading to payment disputes

- Underutilized rate cards for specialized services

- Inconsistent expense reimbursement practices

Healthcare

The healthcare industry faces unique revenue challenges including:

- Coding errors that result in claim denials

- Missing charge capture for procedures or supplies

- Outdated fee schedules with payers

- Incomplete patient information preventing proper billing

- Missed eligibility verification leading to uncollectible charges

Telecommunications

Telecom providers commonly experience leakage through:

- Unbilled network usage due to system gaps

- Rating errors for services

- Incorrect application of tariffs or regulatory fees

- Missed billing for equipment or installation

Promotional discounts that continue beyond intended periods

How to Calculate Revenue Leakage

Quantifying revenue leakage is essential for prioritizing prevention efforts and measuring improvement. Here’s a systematic approach to calculating revenue leakage in your organization:

Basic Formula

The fundamental formula for revenue leakage is:

Revenue Leakage = Expected Revenue – Actual Revenue

However, calculating the “expected revenue” requires a more detailed approach:

Step-by-Step Calculation Process

- Establish your baseline: Determine what your revenue should be based on:

- Contracted amounts

- Published price lists

- Standard rates for services

- Historical performance adjusted for growth

- Identify leakage categories: Break down potential leakage into categories such as:

- Pricing leakage (discounts, price errors)

- Volume leakage (unbilled units or services)

- Time leakage (delays in billing or collections)

- Process leakage (errors, missed steps)

- Sample and extrapolate: For each category:

- Take a representative sample of transactions

- Calculate the leakage rate within the sample

- Extrapolate to your full revenue base

- Calculate total leakage: Sum the leakage from all categories

Express as a percentage: Divide total leakage by expected revenue to get your leakage rate

Ready to Transform Your Revenue Leakage Strategy?

Revenue leakage silently drains your company’s profits, with most organizations losing 1-5% of their earnings annually to this invisible threat. The good news? These leaks are preventable with the right approach and tools.

The biggest challenge most companies face is visibility—you can’t fix what you can’t see. Revenue Grid’s platform gives you complete visibility into your revenue operations, automatically identifying leaks and providing actionable guidance to seal them before they impact your bottom line.

See how Revenue Grid can help your business stop revenue leakage for good. Request a demo today and discover how much revenue you could reclaim.

How can revenue leakage be stopped?

Revenue leakage can be stopped through a systematic approach that includes:

- Automating data capture and entry to eliminate manual errors

- Implementing robust approval workflows for discounts and pricing exceptions

- Integrating systems to ensure seamless data flow between CRM, ERP, and billing platforms

- Establishing regular revenue assurance audits to identify and address leakage points

- Training staff on proper revenue management processes and the importance of accuracy

- Using revenue intelligence tools that provide real-time visibility into potential leakage areas

How do you track revenue leakage?

Tracking revenue leakage requires monitoring several key metrics and implementing specific processes:

- Compare expected revenue (based on contracts and standard pricing) to actual collected revenue

- Monitor discount rates and exceptions against authorized levels

- Track billing accuracy through regular audits of invoices against services delivered

- Measure days sales outstanding (DSO) and collection effectiveness

- Implement revenue assurance dashboards that highlight variances and anomalies

- Use revenue intelligence platforms that automatically identify potential leakage points

What is revenue leakage in project management?

In project management, revenue leakage occurs when billable work is performed but not properly billed to clients. Common causes include:

- Scope creep without corresponding change orders

- Unbilled time spent on client work

- Failure to bill for all reimbursable expenses

- Delays between work completion and invoicing

- Incorrect application of contracted rates

- Missing milestone billing opportunities

What is revenue leakage in SaaS?

In SaaS businesses, revenue leakage typically occurs through:

- Failed subscription renewals due to payment processing issues

- Customers exceeding usage limits without triggering appropriate charges

- Discounts that continue beyond promotional periods

- Missed upsell opportunities when customers hit usage thresholds

- Billing at outdated prices after price increases

- Provisioning services before payment confirmation

What is revenue leakage in healthcare?

In healthcare, revenue leakage commonly occurs through:

- Coding errors that result in claim denials or downcoding

- Missing charge capture for procedures, supplies, or medications

- Incomplete documentation leading to inability to bill for services

- Failure to verify insurance eligibility before providing services

- Missing prior authorizations resulting in denied claims

- Outdated fee schedules with payers

What is revenue assurance?

Revenue assurance is the set of activities and processes designed to ensure that all revenue is properly recognized, billed, and collected. It includes:

- Systematic monitoring of the entire revenue cycle

- Regular audits to identify potential leakage points

- Process improvements to prevent revenue loss

- Cross-functional collaboration between sales, operations, and finance

- Technology solutions that provide visibility into revenue processes

- Governance frameworks that establish clear accountability for revenue accuracy