Our love of screen time hasn’t only transformed our personal lives; it’s also changed the game for sales teams, now operating on longer buying cycles and adjusting to a sales strategy that focuses on journeys and long-term relationships more than the old “always be closing” values of old.

See, “all things screens” has turned the buyer experience on its head. B2B buyers now watch videos, check their socials, and take to the mobile web to research purchases big and small—you know, just like their B2C counterparts.

The difference between say, a shopper scrolling through Instagram for makeup ideas and new clothing brands and the enterprise B2B buyer is, for the latter, choosing the wrong vendor could mean getting trapped in a long-term toxic relationship at the expense of their reputation. Just as you probably wouldn’t marry someone after looking at their OkCupid profile once or twice, smart buyers know that in B2B, it pays to take things slow.

Read on to learn more about selling to research-driven buyers by making a great impression during this long courtship period.

What does the average B2B buyer even want?

Buyers, many of whom fall firmly into the millennial demo, grew up online and bring their digital expectations and savvy into the workplace. Product information, reviews, and pricing information are relatively easy to find and people can educate themselves within a few clicks.

Because of this shift in how buyers consume and access information, something like 57% of the buyer’s journey is traveled alone through self-guided research.

There’s no sales rep serving as the persuasive Sherpa always angling for the close, which removes some of the pressure early in the buying cycle. Yet, that also means there’s no one there to answer questions or separate fact from fiction.

And, just because B2B buyers often want to “go it alone,” doesn’t mean they don’t eventually want to talk with someone who can help. A recent Gartner survey revealed that today’s buyers struggle with information overload, as evidenced by the following stats:

55% of respondents reported feeling overwhelmed by information while researching products.

44% say they struggle with product-related information from multiple sources that seems contradictory.

15% of buyers spend time trying to decode conflicting messages between vendors.

Because most buyers know their way around the search engine, salespeople must step up their game and offer something that Google can’t provide, information that is tailored specifically to the buyer’s industry and the challenges that come with the territory. Essentially, buyers want to compile their options, but they want someone to help them make sense of the information they’ve gathered.

Long sales cycles don’t mean reps can sit around and wait for the phone to ring.

This stat is an oldie but a goodie from HBR: companies that respond to new leads within an hour are 7x more likely to have a productive interaction with a key decision-maker. By contrast, those who waited 24+ hours to make contact were 60x less likely to have a conversation. Like, any conversation whatsoever.

While that HBR stat refers to the initial outreach effort, another study from Demand Gen Report further underscores the importance of delivering value early on, finding that the one-to-three-month mark is a critical point in the decision-making process.

While buyers might not be ready to pick a solution for a few more months, many vendors get the ax before they realize they’re even in the mix. For sellers, this means that you’ll need to take a proactive approach by acting as an informational curator of sorts.

Marketing and sales need to get cozy.

According to LinkedIn’s 2018 State of Sales report, 77% of buyers won’t engage with salespeople that don’t have detailed knowledge or insights that relate to their business. Marketing—or rather a sound sales enablement strategy can help solve this problem by getting reps prepared by giving them content that speaks to buyers’ needs.

The problem is, marketing teams may not know exactly what those needs are. According to HubSpot data, sales reps reported that only 7% of leads sourced from marketing efforts met their quality standards.

That’s… pretty terrible. Fortunately, we’ve laid out a few ways that sales and marketing teams can get connected.

Hash out a shared understanding of the entire buyer’s journey

Marketing and sales work must work together to both map out the buyer’s journey and conduct persona research. Keep in mind, however, that it’s not so much about creating template personas like “Marketing Director Molly” or “Sales Enablement Sam.” Spoiler alert: they’re not real. Personas should be based on real data based on your experience working with someone in that industry and role.

You should also focus on speaking to the 6-10 decision-makers involved in this process. So, one deal might include talking to Molly, Sam, and eight of their colleagues, creating multiple pieces of content that provide slightly different views on what their new SaaS tool can do to help them specifically.

Address each of these personas in detail, working through how they move from identifying a problem to choosing a solution. Keep in mind, your B2B buyers deal with an awful lot on their side of things.

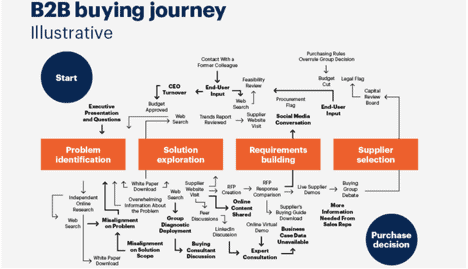

Per Gartner’s illustration below, you’re looking at a journey where the primary decision-maker does some research, starts assessing possible solutions, then has to double back to make sure the rest of the team is on the same page. At that point, you can assume one person got lost, another found something they liked better, and now, the team is forced to move backwards to regroup.

Be an (buyer) enabler

Customers no longer follow a linear path from lead to customer. Gartner (yes, Gartner again) research found that there are six “jobs” that customers complete internally before deciding it’s time to pull the trigger.

The Gartner report advises that sellers need to embrace this idea of buyer enablement, which essentially means they need to serve the content that allows them to complete each of these jobs.

According to research by Corporate Visions, less than a third of companies surveyed actually include sales in the content creation process. Instead, sticking to the old way of doing things where marketing creates and promotes content themselves, while sales is off doing their own thing.

Part of the content problem has to do with the early days of content marketing before sellers, the C-Suite, and other stakeholders were convinced of its value.

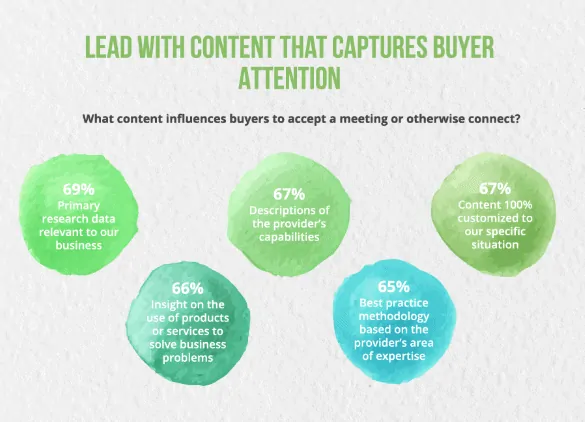

What kind of content do buyers want? The short answer is buyers want something that answers questions, brings up new possible solutions, and helps them understand how taking action would specifically impact their unique situation.

This graphic from the Rain Group not only delivers some solid watercolor effects (seriously, it’s cool), but it also provides some examples of which types of content actually provide value to buyers. Original research, custom content, and descriptions of how the seller’s solution actually works are what captures the buyer’s attention and holds it–if of course the content makes it clear that it can solve the buyer’s pain points.

Additionally, you’ll need to make sure that you have the tools in place to measure content performance. Platforms like Bigtincan, Seismic, and Highspot are solid sales enablement platforms. Though each is a bit different, all three simplify the content management process by allowing teams to collaborate on sales collateral, map content to specific touchpoints, and report on prospect engagement.

We recommend looking for a sales enablement platform that syncs with your existing tech stack and CRM, so you can review sales content performance alongside customer communications records and sales reports for a complete view of your strategy.

The new B2B buyer’s journey is paved with fresh insights and high-level (tailored) content

With B2B buyers researching solo, custom solutions now power the B2B buying process. For sellers, that newfound independence means their job is now buyer-centric, not product-centric.

Different types of buyers will expect different information that speaks to their unique concerns while still considering the impact on the entire organization.

If you look at an industry like the SaaS space, most products come with a ton of information on their site, from the knowledge base to the blog. Which means, buyers can find a ton of information on any product, its competitors, key features, and pricing, but may not have a clear understanding of how that solution specifically benefits their organization.

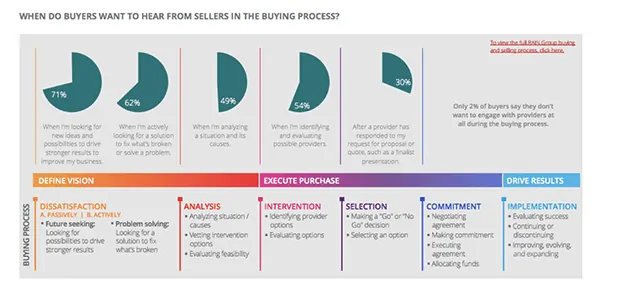

This LinkedIn graphic does a nice job of breaking down buyer expectations as they move through the sales cycle. Sales and marketing need to identify the problems, goals, and solutions that make sense for each group, using a combination of high-level marketing data and the personal anecdotes gathered by sales.

Make B2B selling social.

According to Google and Millward Brown Digital, 46% of decision-makers are now part of the 18-34-year-old demographic group, which as it so happens, is also the largest social media demographic. So, why not meet your buyers where they are and embrace the life-changing magic of social selling?

According to LinkedIn research, several industries have seen their revenues rise by 50% by embracing social selling.

If you’re not familiar with the term, social selling is the process of using social media to identify and nurture prospects. What social selling is not about is sending “just following up” messages in bulk or cold-pitching people you’ve never met. That’s just spam.

Instead, focus on having real conversations with people in your target market via LinkedIn Groups, Twitter Chats, and by messaging individual prospects in your network.

You’ll also want to invest in a social listening tool. SproutSocial, Nimble, and Rfctr’s Social Port are all effective tools for automating repetitive social selling tasks. SproutSocial allows users to “listen in” on what’s happening on social media channels—which can be useful for both marketing and sales. Rfctr is more sales-specific and looks closely at content performance in a social selling context, while Nimble offers a sales-focused CRM that supports social selling.

Regardless of which social selling tool you choose, we recommend investing in LinkedIn’s Sales Navigator as well. This tool integrates with your CRM, offers lead recommendations, and tracks deals as they play out on the platform.

Bring retention into your sales and marketing strategy.

The slow sales cycle means that it’s more expensive and time-consuming to close a deal than ever—so driving revenue depends on relationships—the long-term kind. We won’t go into the importance of retention—we’ve all seen the statistics, but post-sale, make sure you have a sound strategy in place for the following:

- Offering ongoing service and support

- Collecting and acting on feedback

- Providing relevant offers and recommendations that bring more value to your customers over time.

- Continue sharing useful, personalized content

In the world of B2B sales, things like tech support, customer service, and open communication channels are critical and customers expect you to continue to offer that same level of attention and support as when you were working the deal. Make sure you use automated tools like follow-up reminders, email sequences, and marketing automations to stay on top of staying connected.

B2B buyers spend upwards of seven months making a decision, so you better believe that they are thinking well beyond the actual purchase. They A: want to know that you’ll be there to support them after the sale and B: they don’t want to go through this entire process again.

Final Thoughts.

As B2B buying habits evolve, those reps that can’t keep up and support research-driven buyers early on lose. It doesn’t matter if the buyer’s journey is best traveled alone, and on many different channels, sales reps need to look alive and deliver insights, solutions, and compassion to buyers when they’re ready.

The best way to do that? To find the right instruments that can help sales and marketing teams connect with today’s buyer with built-in selling recommendations, rule-based email automation, and deep insights that help teams quickly understand the impact of their efforts. Oh, and don’t forget it should all syncs up with your CRM.