Sales teams have a real ability to influence the Lifetime Value (LTV) of a customer. The funny thing is, LTV is rarely mentioned in the salesroom.

The reason LTV may be shrugged at is that it’s used to estimate a customer’s future worth. It’s a calculated guess, but it’s not foolproof. But here’s the kicker: if your calculations are on point, knowing a customer’s LTV can help your company make smarter marketing and sales decisions.

So here’s the takeaway for sales managers and account managers: if you’re neglecting to focus on LTV in the salesroom, you’re also missing opportunities to increase your company’s bottom line.

Back in 2012, HubSpot pulled back the curtain on how they tracked their LTV. The company told Forbes they tracked their CAC (customer acquisition cost), Monthly Recurring Revenue (MRR), Churn as well as their margins to find their customer’s LTV.

The result? HubSpot’s Brad Coffey likened the formula to a machine: put a dollar in at the top and the LTV: CAC ratio will tell you roughly how many dollars come out at the bottom.

“If your money isn’t multiplying, you’re going to want to spend some time tuning that machine,” he says.

The reality is that the higher the customer’s LTV, the more profitable they’re going to be for your company. And sales teams have the power to directly influence just how high a customer’s LTV can be. Building customer relationships, increasing Average Order Value (AOV), and rewarding loyal customers are all ways in which companies can increase a customer’s LTV.

And what all those factors have in common is that they take place in the salesroom.

In this guide, we’re going to uncover:

- The nuts and bolts of LTV

- How sales can influence a customer LTV

- 5 Ways Sales Teams Can Influence Customer LTV

Let’s dive in.

The nuts and bolts of LTV

A customer’s LTV is defined as the dollar value they will spend throughout their lifetime with your company.

LTV is typically calculated like this:

Knowing your customer’s LTV has three core benefits.

- Balancing customer acquisition spending: we will get into this later, but if you know what your LTV is, it’s easier to understand how much you can spend on marketing and sales to close new customers without going bankrupt

- Figuring out your Customer Acquisition Costs (CAC) Payback Period: When you bring a new customer on-board, you’re already in debt for how much it costs to get to that point. This is called CAC, and knowing your LTV will help you determine how long the debt will take to pay back, and if your model is profitable or not

- Keeping the investors happy: Unless your company is bootstrapped, you likely have a bunch of investors who want to know how fast you are growing, and how long it’s going to be until you’re turning a profit. If you don’t know what your LTV is, or if it’s healthy, it’s hard to show if your team is on the right track for growth

Obviously, having a higher LTV is the aim. It means you can stop sweating so much about customer acquisition costs (CAC), and it shows your customers are more loyal (lower churn, woo!).

But what is a good LTV to aim for?

It depends on your company and whether you’re relying on subscriptions or one-off payments. As a rule of thumb for most SaaS products, if your LTV is over $1000 you’re into the “fairly comfortable” range. And it’s when you’re at or over this $1000 LTV mark, says Close.io’s Steli Efti, that investing in a dedicated sales team becomes worthwhile.

CAC directly impacts LTV

We can’t talk about LTV without talking about CAC. The two metrics are basically married to each other.

The secret sauce to a successful SaaS is cutting your CAC while, at the same time, growing your customer’s LTV. If you’re cutting the costs involved with getting new customers, and at the same time making those customers more valuable, you’re left with a full-proof recipe for growth.

According to marketing guru Neil Patel, acquiring new customers can cost seven times as much as making sure your current ones stick around, so it’s easy to see why CAC and LTV go hand in hand.

While it’s always a good idea to get prospects down your sales funnel, increasing the LTV of your current customers can also dramatically move the needle.

So, what does all this look like in a real-life scenario?

Let’s look at San Francisco SaaS company Buffer as an example. According to research by GetLatka, in 2015 the company has an LTV value of 20 months/$299 and a churn rate of 5%.

Not bad, right?

Here’s where it gets interesting, though. Buffer’s CAC was just $50, which leaves their CAC/LTV ratio sitting at 6:1. And with more than 50,000 customers under its belt, the figures meant their Monthly Recurring Revenue (MRR) was nearly $800k.

Your company’s revenue stream always relates to how long your customer’s stick around. And that MRR, ladies and gentlemen, is why your company needs to start taking note of your customer’s LTV.

Pro-tip: If you want to find out your rough customer LTV quickly, use this calculator from ChartMogul.

How sales can influence a customer LTV

A customer’s LTV can be heavily influenced by sales, which makes it even more mysterious that sales teams sometimes ignore the metric.

It’s the marketing team’s problem, right? Well, not exactly.

According to the sales bible, Marketing Metrics, the possibility of selling to a new prospect is between 5 to 20%. But if one of your sales reps is trying to sell to a current customer, the odds swing in their favour, to 60-70%.

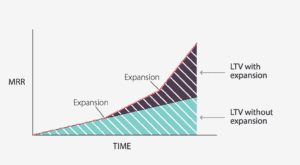

That’s why your sales team can have a massive impact on your customer’s LTV and as a result, your company’s overall revenue. The problem is, a lot of sales teams don’t even consider that they have the power to influence a customer’s LTV. And part of this is because the simple formula sales teams often use doesn’t account for LTV expansion.

Using the traditional formula, the LTV won’t change when a sales rep makes an upsell or cross-sell. But if you start to think about LTV as an expanding metric, we can begin to see the influence a sales team can have:

Here’s an example to show just how much a sales rep can influence a customer’s LTV.

Let’s say you have a customer who is on a subscription, and they pay $100/month. You expect them to stick around for about 12 months. So, that customer is worth $1200 to your company.

Now, let’s say your sales rep upsells them in the fourth month of their subscription, increasing their spend to $150. And your sales rep is so good, they upsell them again in their eighth month to $180 (plus, your sales rep gets a gold star for being freakin’ awesome).

That customer still churns after 12 months, but the sales rep has increased their LTV to $1800. And that’s why expansion matters when it comes to LTV.

It’s figures like that where we can see the real power of how a sales team can impact a customer’s LTV.

So, how can you get your sales team to start thinking about LTV? Let’s look at five ways they can influence your customer LTV, and your bottom line.

5 Ways Sales Teams Can Influence Customer LTV

1. Sell them on a subscription model

One of the most powerful ways to improve your LTV is to turn your product into a subscription. When your sales reps have the opportunity to sell a subscription product to prospects, they can secure a recurring stream of revenue.

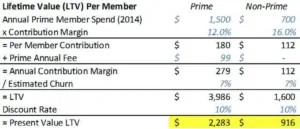

Subscriptions are money machines. Your customers pay more, they stick around longer, and they become more valuable. Case in point: Amazon and their Amazon Prime Subscription.

Motley Fool’s Brendan Mathews studied the company’s subscription model against its non-subscription customers. He found the LTV of a customer with an Amazon Prime subscription was worth double to the company compared to their non-prime counterparts.

Mathews says it’s clear Prime members are significantly more valuable to Amazon over non-Prime shoppers, and Prime members contribute significant added value to Amazon’s business.

“As Amazon’s business mix shifts to include more Prime members, there is potential for operating leverage and margin expansion,” he commented.

2. Make sure the leads in your funnels are legit

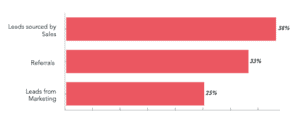

Are your sales teams relying on leads passed over to them from your marketing team?

If so, it might be time to shake things up. A study by HubSpot found the sales team themselves sourced a company’s best leads:

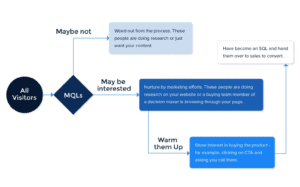

It makes sense. If your sales reps are spending all their time closing leads that aren’t a good match for your product, the result will be higher churn and lower LTV. Now, we’re not throwing your marketing team under the bus. But the reality is, as many as 90% of Marketing Qualified Leads (MQLs) never turn into Sales Qualified Leads (SQLs) because they were tagged as MQLs too early in the buyer’s journey.

The result is your sales team wasting a ton of time on leads that, well, didn’t have a real need for your product in the first place. And that means they’re never going to stick around for long. Your sales reps can change this by filling their pipeline with higher quality leads.

Much of the potential for a customer’s LTV is made before they make their first purchase. If they aren’t a good fit for your company, they won’t last long. Get your sales team on board with finding higher quality sales leads, instead of just trying to close as many deals as possible.

3. Build those customer relationships with emails

A study by Bain & Company found that a 5% increase in retention rate can give you a profit boost of anywhere from 25% to 95%.

It doesn’t take a genius to know that the longer your customers stick around, the higher their LTV will be.

But building a relationship takes more than your sales reps sending out promotions and offers. To keep a customer (and ultimately increase their LTV), sales reps need to nurture a relationship with them. And one of the best ways to do this is by using good ol’ email.

Whether your sales reps use email marketing to nurture active customers through drip campaigns, or as a weapon to reach out to customers who haven’t purchased in a while, sending them an email works. GetVero Co-Founder Chris Hexton says sales reps can use email marketing as a way to implicitly drive customers to spend more with their company.

“In the case of SaaS products this is generally done by educating your customer with regular emails that help them get more value out of your product,” he says.

“MixPanel, for example, could send educational emails that explain why it’s useful to track button clicks on your landing page.

“This sort of education would not only inform customers of new ways to use the product but get them tracking more data points. This is incidentally the driver that decides which tier a customer subscribes to: the more data points they track, the more they ultimately pay.”

Genius? We think so. And the longer a customer stays with your company, the more loyal they become.

4. Work to increase their Average Order Value (AOV)

Yep, we’re talking about upselling.

Sales reps can increase LTV by upping the average order size when they’re closing a customer. This might seem like a “duh!” tip, but hear us out. When your sales reps are attempting to upsell, they’re asking the customer if they want the product they’re already interested in, but just a slightly better version of it.

The additional features and benefits make it a fair value exchange. And the result is a faster-growing company than one that relies on upsells.

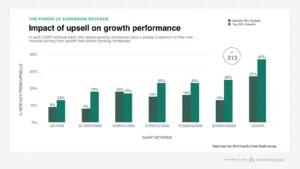

In an article on ProfitWell, Patrick Campbell says companies that are growing faster get more of their new annual contract value (ACV) from upsells.

“Slower growth comes from acquiring entirely new customers,” he says.

So, the ball can be in the sales team’s court to steer the growth of a company through upselling. Remember, upselling existing customers has a 60-70% chance of success. So if it’s not part of your sales strategy already, you’re leaving a big chunk of change on the table.

5. Reward Customer Loyalty (and your best customers)

One of the best ways sales teams can increase their customer’s spend, and in turn, their LTV is by offering up rewards to do so.

A study by Lab42 showed that 73% of millennials’ spending habits were directly related to loyalty programs. And a further 60% of consumers said they could be influenced into purchasing products if a company offered a loyalty rewards program.

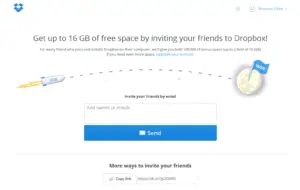

One of the best examples of a SaaS increasing customer loyalty and LTV with a referral program is DropBox. The company introduced a referral program that offered a product upgrade instead of a money bonus, which helped spread the word about their service and build customer loyalty in the process.

The results? DropBox permanently increased its sign-ups by 60%. Within 15 months, they took their customer base from 100,000 to an eye-watering 4 million. And 35% of the new sign-ups were thanks to the referral program.

Offering up referral programs is an excellent way for sales teams to promote their products while signing up more customers at the same time.

Boosting LTV is everybody’s responsibility, including your sales team

LTV isn’t just for your marketing customer care teams to worry about.

When it comes to boosting how much your customers are worth to your company, a lot of it depends on how well a sales rep nurtures their customer relationships, and what upsells they’re able to offer customers.

The exciting thing about LTV is, it compounds. A customer that’s worth $100/month is great, but if a sales rep can turn that customer into a $150/month for the rest of their customer lifetime, the impacts on revenue can be massive.

And boosting LTV isn’t rocket science. Sales reps need to stick to the stuff that works. Building meaningful relationships with their clients and rewarding customer loyalty with perks can be the difference between a valuable customer for life, and one that churns.

If you’re not already prioritizing LTV in the salesroom, do it. The compounding LTV of a customer can make or break the success of your SaaS.