Revenue performance is a critical metric to look at when you are trying to assess a company’s financial health. It can give you a good indication of how well the company is doing in terms of generating sales and profits.

This article will explain revenue performance in detail.

What Is Revenue Performance?

Revenue performance is a process used to analyze and improve sales and marketing efforts using revenue as a focal point. It’s a data-driven methodology that considers KPIs that have a direct bearing on revenue generation to shed light on flaws and hitches in sales, marketing, and how the two departments interact. It’s important to understand that revenue performance is not just about meeting goals—it’s also about how well the company performs in terms of how much money it makes, how efficiently it uses its resources, and how well it can predict its own future.

Revenue Performance Management

Revenue Performance Management (RPM) is a strategic approach to managing an organization’s revenue generation activities. It is designed to help organizations optimize their revenue-related decision-making and execution to drive sustainable, profitable growth.

When adopting an RPM approach, you can see improved financial performance, operational efficiency, and better decision-making across your company. In addition, RPM can help you better understand and manage the complex relationships between your revenue-generating activities.

Why Revenue Performance Management Is Important

As said earlier, revenue performance is crucial because it can indicate how well your business is generating revenue. By measuring it, you can ensure you’re on track to meet your financial goals.

Revenue performance is also a good way for investors to evaluate a company or organization. When looking at a company’s revenue performance, investors can get an idea of the company’s overall health and its ability to generate profits.

Keys to Revenue Performance Management

RPM aims to maximize revenue growth and profitability by aligning all aspects of the organization around a common set of KPIs, processes, and tools.

The keys to success with RPM are:

1. Executive buy-in and sponsorship: Without senior management buy-in and sponsorship, RPM initiatives are likely to fail. Senior managers need to be intimately involved in planning and executing RPM initiatives.

2. The right team: As with any initiative, the success of RPM depends on the people involved. The team should deeply understand the revenue cycle and the factors affecting revenue growth. They should also be able to work together effectively to execute the RPM strategy.

3. Well-defined processes and tools: RPM relies on well-defined processes and tools to manage the revenue cycle. These should be designed to support the team’s ability to execute the RPM strategy and achieve the desired results.

4. The right technology: The right technology is critical for any RPM initiative. Technology can help automate and optimize key processes, provide visibility into all aspects of the revenue cycle, and enable real-time decision-making.

5. Measurement and feedback: RPM initiatives need to be measured and monitored regularly to ensure that they are executed appropriately. Feedback should be used to course-correct as needed.

By following these keys to success, you can realize the full potential of RPM and drive significant improvements in revenue growth and profitability.

How to Increase Revenue Performance

To increase revenue performance, you should focus on two areas: operational improvements and pricing.

Operational improvements involve making changes to the way your business runs to increase efficiency and decrease costs. This could include automating processes, streamlining operations, or reducing waste.

Pricing involves altering the price of your products or services to increase sales. This could include discounts, bundling products, or introducing new pricing tiers.

Which of these methods you use will depend on the specific circumstances of your business.

How to Track Revenue Performance

Tracking revenue performance isn’t challenging. The most important thing to remember is that there are many different revenue performance indicators, and each business has its own unique requirements for measuring success.

That said, many businesses focus on the following sales revenue performance KPIs:

1. Gross profit margin: This metric measures the percentage of each sale that is pure profit. To calculate it, divide gross profit by revenue.

2. Customer churn rate: This metric tracks the percentage of customers who stop doing business with your company over a period of time. A high churn rate can signal that your prices are too high, your products are of poor quality, or your customer service is lacking.

3. Customer lifetime value: This metric helps you assess how much revenue a customer will likely generate throughout their relationship with your company. To calculate it, divide the total revenue by the number of customers.

4. Sales growth: This metric measures the year-over-year or month-over-month increase in sales. It’s an excellent way to track whether your company is gaining or losing ground.

5. Market share: This metric measures the percentage of your company’s products or services purchased by customers in a given market. A high market share can be a sign of a strong brand or a monopoly.

6. Profitability: This metric measures how much profit your company makes relative to its revenue. To calculate it, divide net income by revenue.

7. Efficiency ratios: These ratios measure how well your company uses its assets and resources to generate sales. Two common efficiency ratios are the inventory turnover ratio and the accounts receivable turnover ratio.

8. Sales data: This data can help you identify trends and patterns in customer behavior. It can also help you determine which products and services are selling well and which ones are not.

9. Financial statements: These statements can provide insights into your company’s overall financial health. They can also help you identify areas that need improvement.

How to Measure Revenue Performance

Revenue performance is usually measured by looking at the total amount of money that a company or organization brings in from sales and then subtracting the cost of goods sold and other expenses.

Revenue Performance Analysis

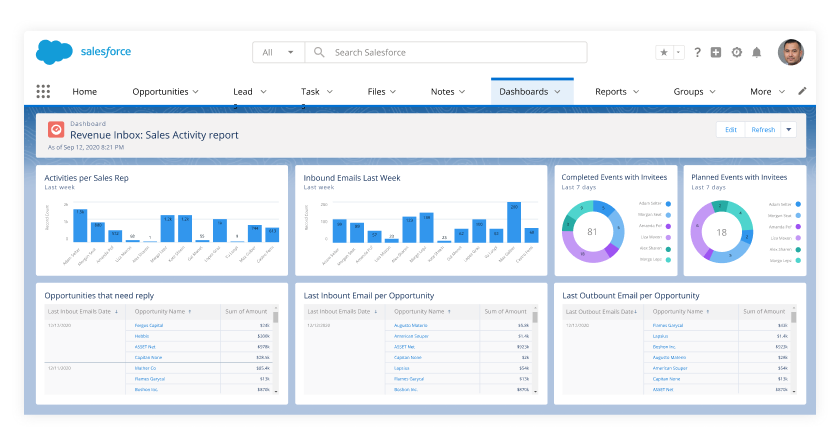

Revenue performance management involves using data and analytics to inform and guide decisions related to pricing, products, channels, customers, and other factors that impact revenue. It also includes implementing processes and systems to ensure that these decisions are executed effectively and efficiently.

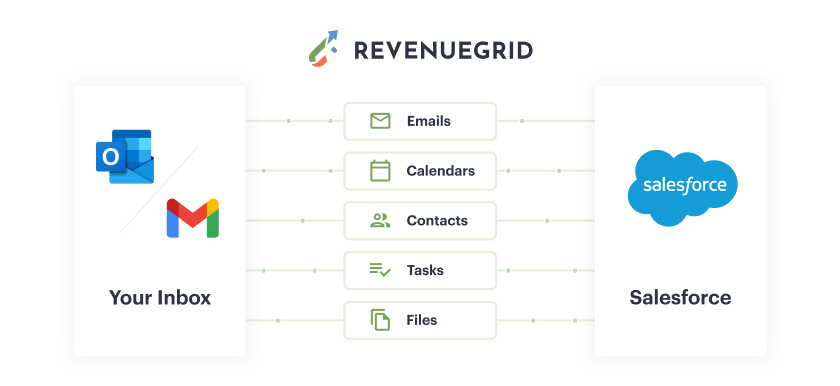

When choosing a revenue performance management solution, it’s essential to consider your organization’s specific needs and select a solution best suited to meeting those needs. You should also consider using an all-in-one revenue intelligence platform like Revenue Grid to centralize all revenue data into one place, making it easy for your teams to work with.

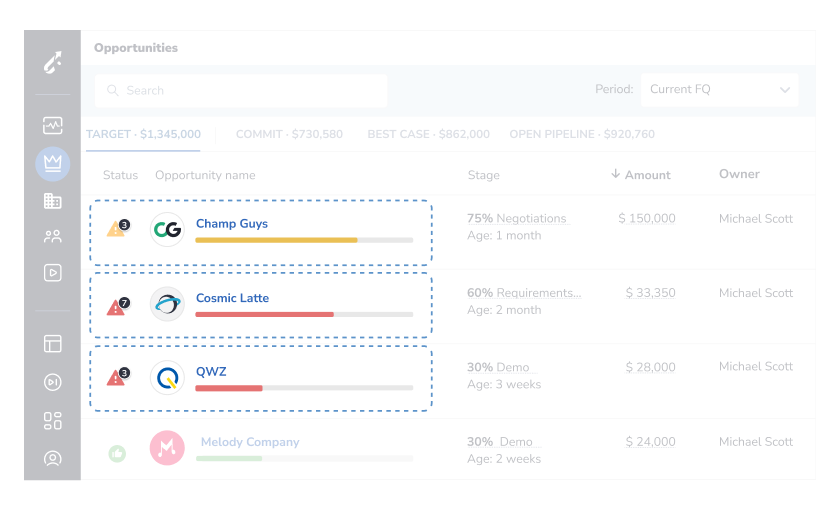

Revenue Grid also enables your sales and revenue teams to identify and eliminate revenue leaks, accelerate sales cycles, and provide better visibility of pipeline performance using real-time contextual guidance. It helps you locate revenue barriers in your sales pipelines and provide actionable steps to address those challenges.

Revenue performance management is crucial for any company looking to maximize its revenue potential.