The COVID-19 global crisis changed the world as we know it forever.

The impact on our economy, society, and future has been so significant, that experts believe a historical divide has occurred. In the sales landscape, business timelines will be split between BC (Before Covid) and AD (After Domestication).

Now that the coronavirus pandemic has solidified its position as one of the biggest global events and challenges of a generation, we all need to find a new way to thrive. Adapting to the landscape in the months and years to come begins with understanding the unprecedented transition that we have all experienced in the last few months.

As experts in the Sales Engagement space, Revenue Grid has conducted research into the sales pipeline before and after COVID-19. We analyzed data from over 500 B2B sales teams. Examining inbound and outbound cycles, activities, and dynamics has allowed us to accurately track how sales strategies are changing.

Aside from conducting in-depth research on sales teams, we’ve also picked up insights and trends from our own team’s experiences and activities.

Read on for everything we’ve learned, including the responses that we got from more than 50 interviews with industry leaders from SaaS companies.

Win rates crash

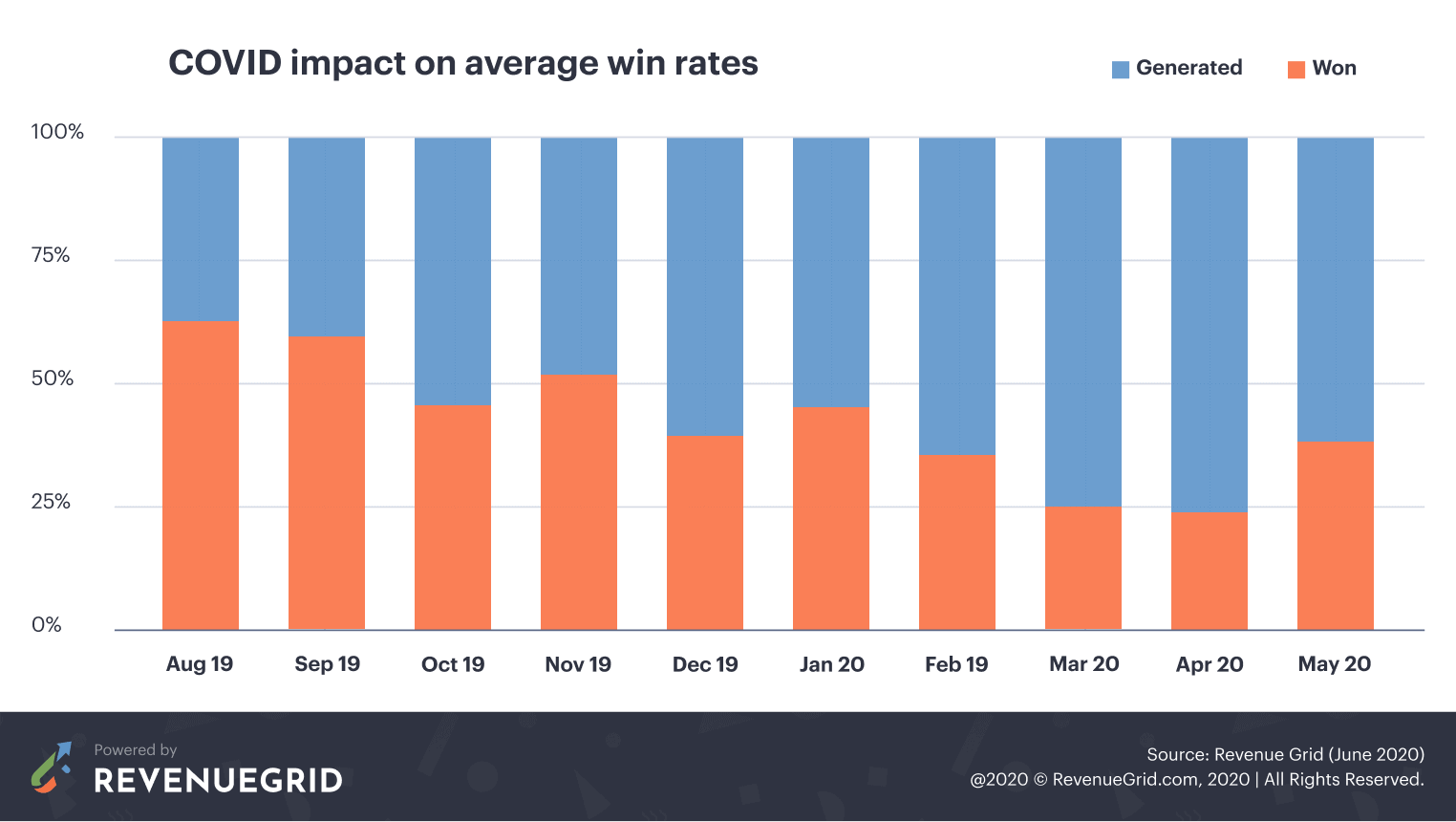

One of the most striking changes in sales in recent months has been the impact on win rates.

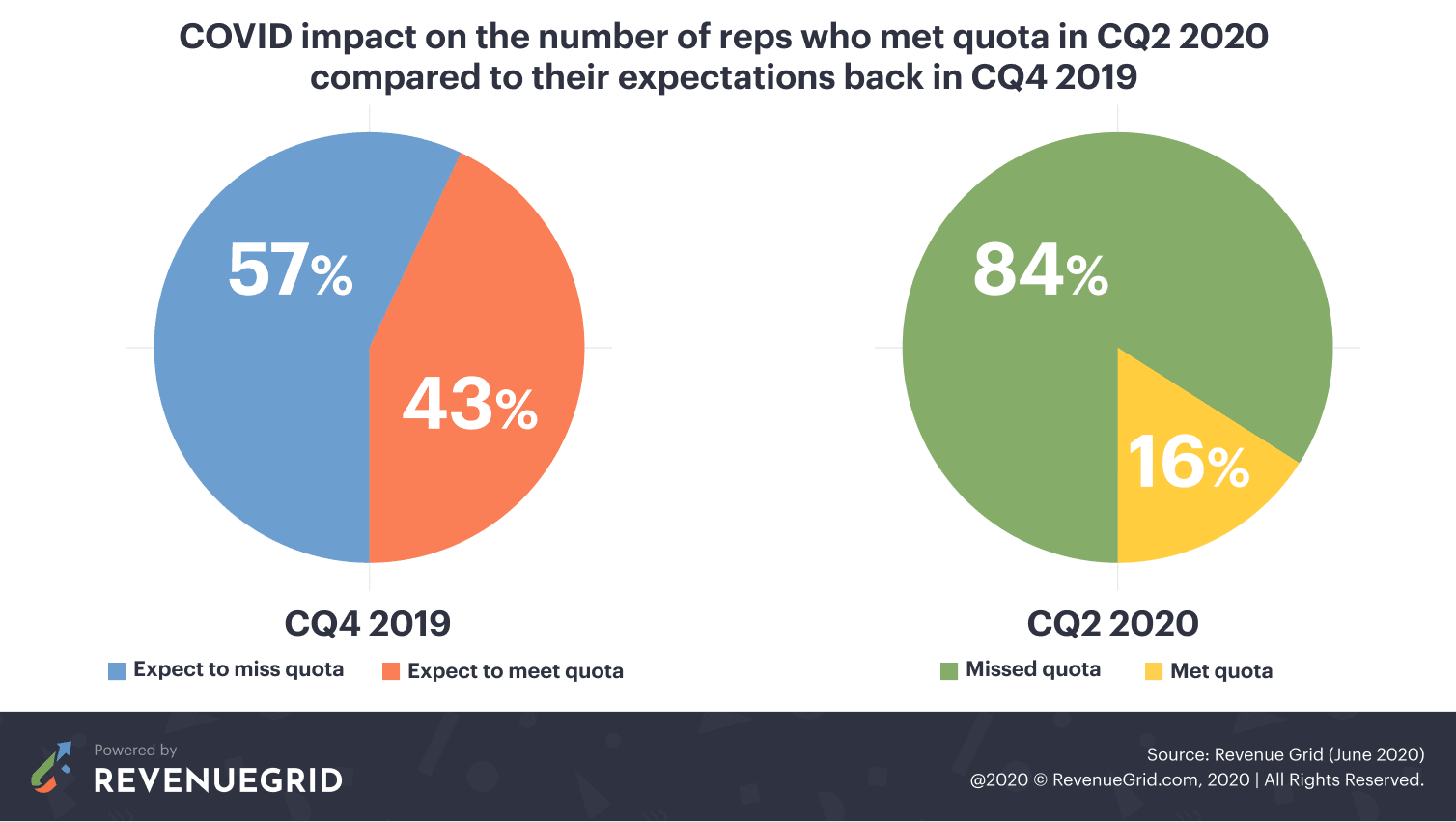

Before Covid, 57% of reps expected to miss their quotas for the following year, and that was during one of the most prosperous economic periods in history. Since the coronavirus began, a staggering 84% of reps report actually missing their quotas.

With an unplanned event like the pandemic, this reflects not on changing quotas, which were laid out before the crisis struck, but directly on a changing average win rate. Clearly, many deals have been put on pause, delayed, or canceled due to economic uncertainty.

It’s important to note that win rate is an extremely powerful metric. Even a small change in win rate can have an outsized impact on revenue.

Take, for example, a medium-sized company:

- 50 sellers

- 8 proposals per seller per quarter

- $75,000 average deal size

When win rate is 50%, this company can expect $15M in revenue per quarter.

At 40% win rate, revenue drops to $12M, that’s a 20% drop in revenue from a 10% drop in win rate.

Prior to the crisis, average win rate across all industries hovered around 47%. Properly formulated quotas should be a hard-to-reach but attainable number. Even a drop of a few percentage points in win rate would demolish quota success for many sales teams. With the number of teams reporting missed quotas, we can hypothesize a drop of up to 10%.

Down-and-up pipeline trend

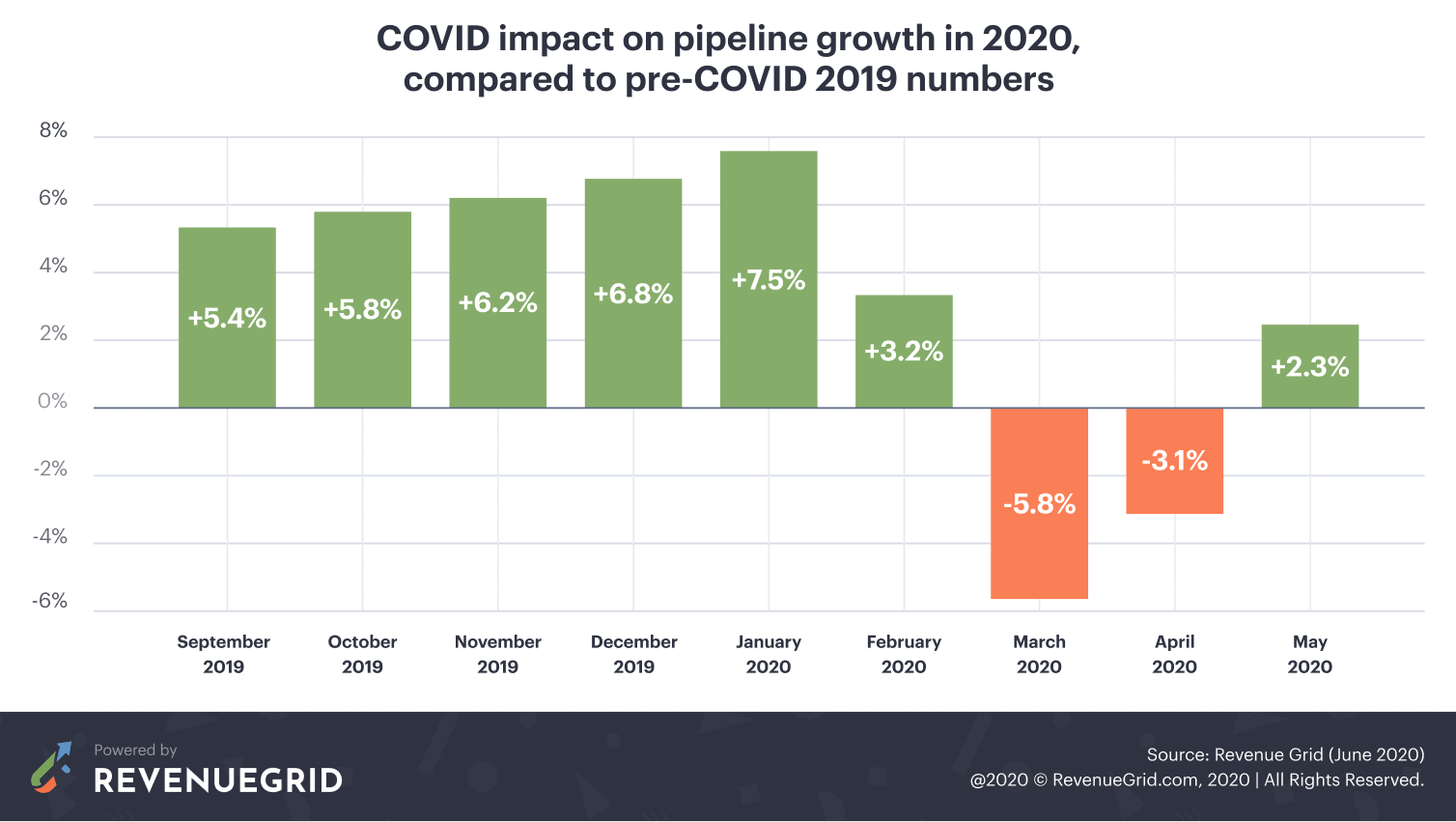

The sales pipeline has seen an obvious shift in recent months. Customer priorities have changed, and with the economy in turmoil, every community’s needs are changing.

The number of unique new accounts:

- Dropped by 8.4% from February to March

- Dropped by 3.7% from March to April

- Increased by 11.1% from April to May

These numbers suggest that pipeline opportunities are re-emerging for companies that know how to embrace the current landscape and respond to customers’ needs.

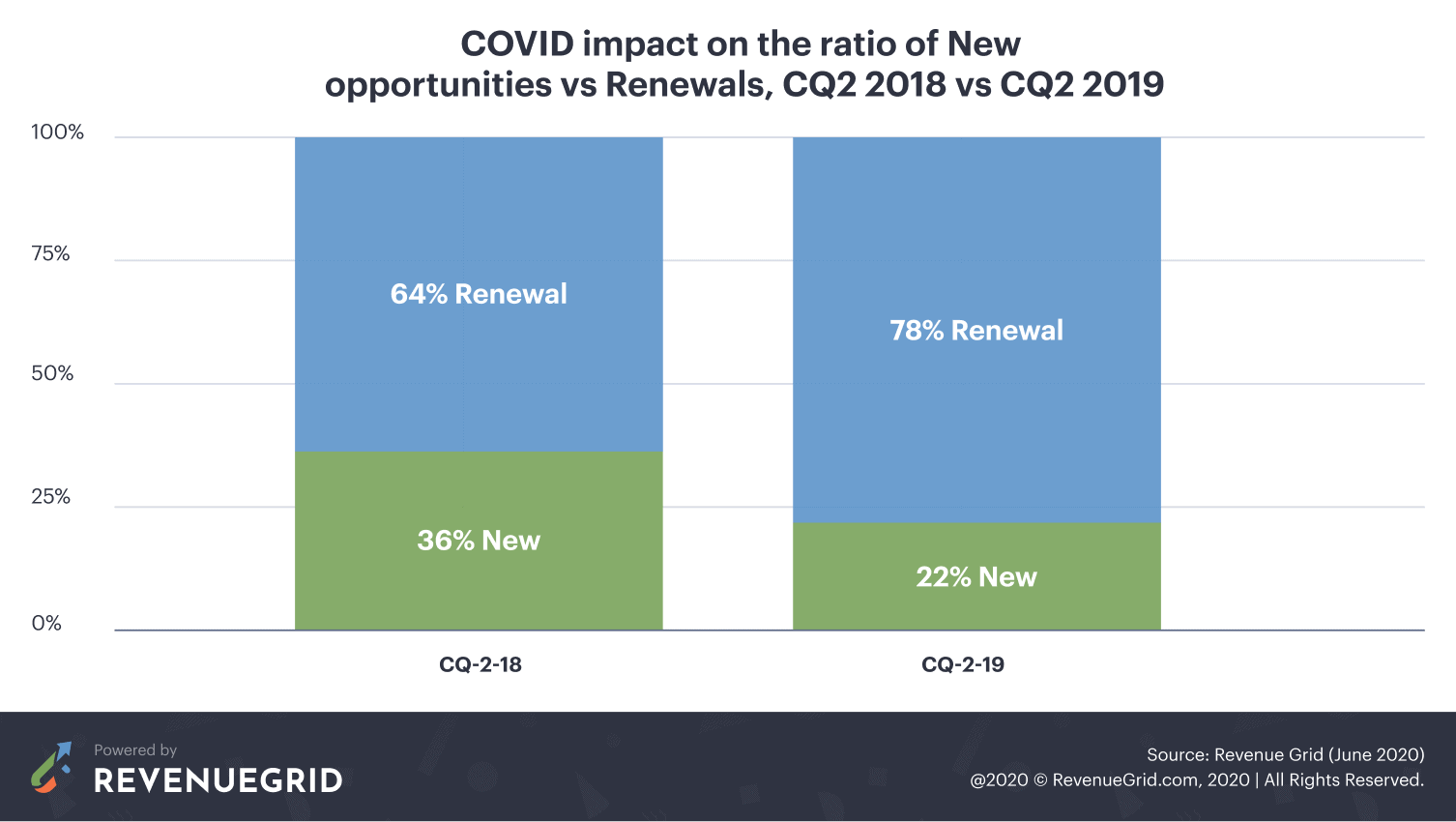

New and renewed B2B accounts

In the fourth quarter of 2018 the number of new accounts reported by sales teams accounted for 37% of new opportunities. Renewal accounts consumed 63% of the share.

In the fourth quarter of 2019, Renewal accounts made up 78% of the opportunities available, with new accounts occupying 22%.

It’s clear that valuable relationships with existing clients will be essential as we move ahead in this new environment. Responding to the needs of your current customers and earning their loyalty will be crucial to preserving your pipeline.

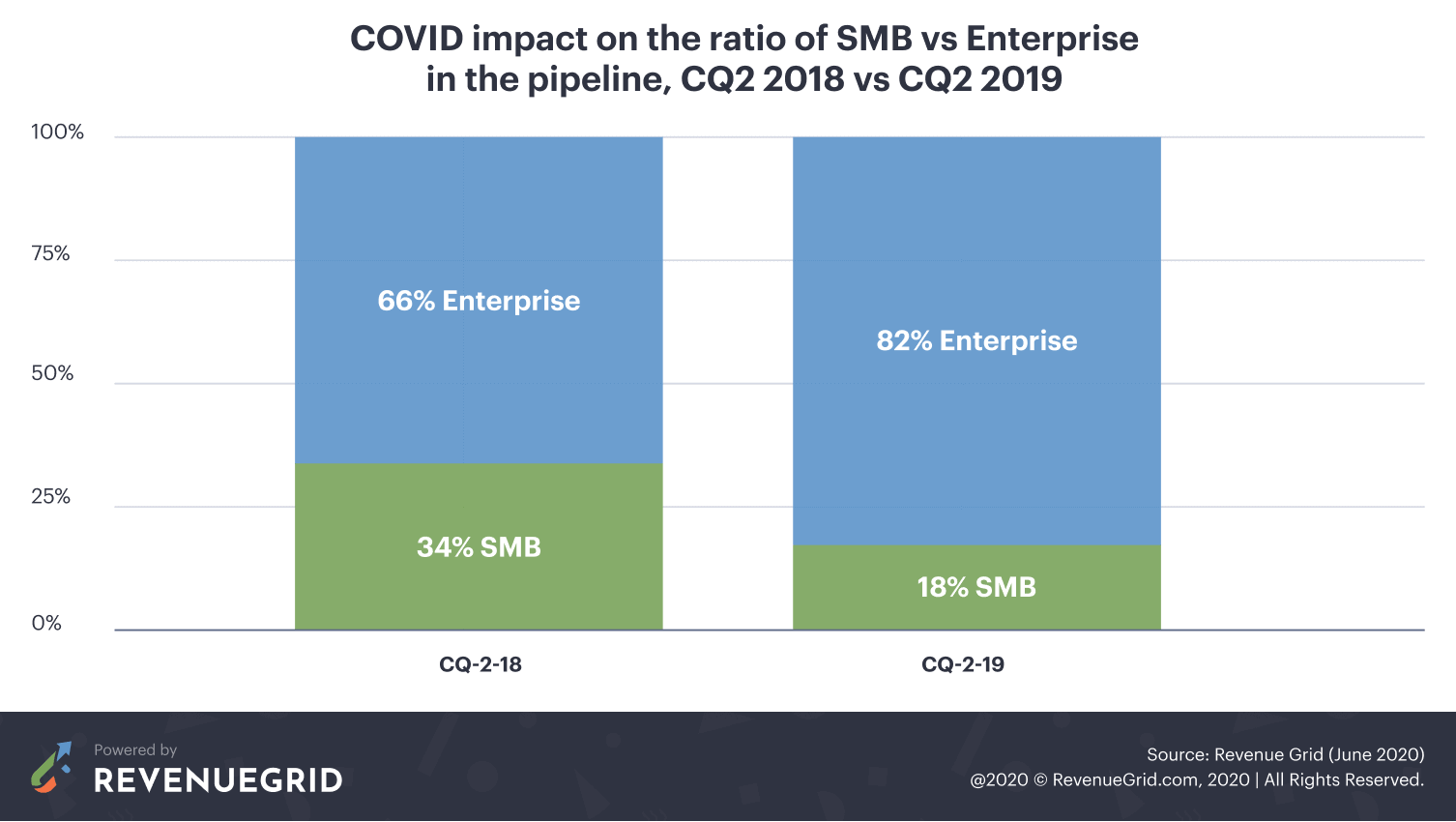

SMB vs Enterprise

Enterprise is a powerful segment of the sales pipeline. This was true even before the rise of the COVID-19 pandemic. However, heading into life AD, we can see that Enterprise opportunities will be even greater. SMB companies may have fewer resources to spend in the months ahead.

34% of opportunities came from SMBs in the fourth quarter of 2018, compared to 66% from Enterprises.

18% of opportunities stemmed from SMBs in the fourth quarter of 2019, compared to an incredible 82% from Enterprises.

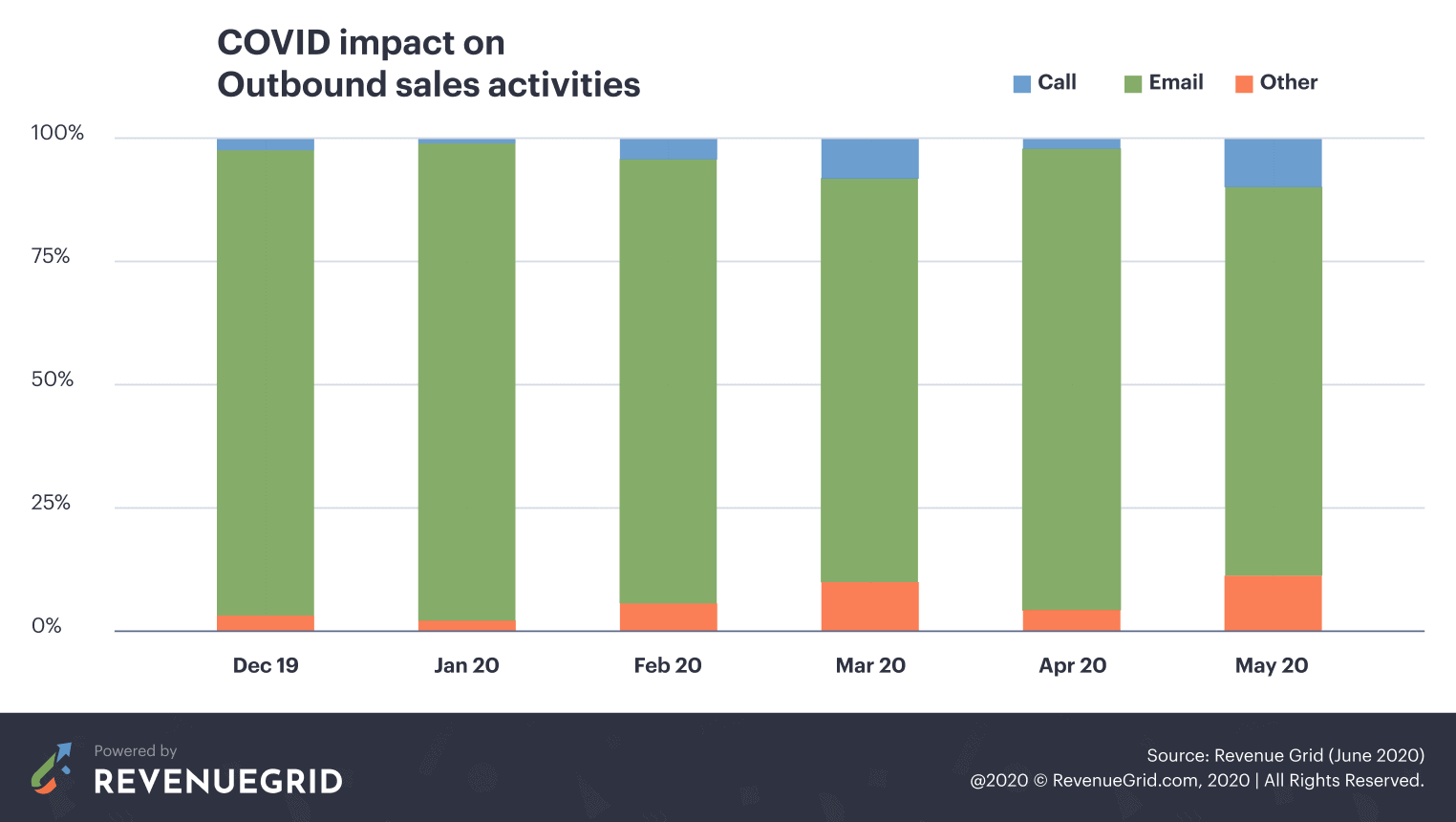

Outbound Sales

During the third and fourth quarters, outbound sales activities increased by 18.5%.

This indicates that today’s sales executives need to move faster if they want to reach their sales quota. Part of accelerating this process means moving communications into a single environment.

Switching conversations from offline environments into a unified online experience will make tracking opportunities quicker and more efficient.

At the same time, the structure of inbound and outbound sales have changed.

Sales teams are making more calls instead of writing emails.

Social media and SMS are also more valuable than email. This highlights a growing need for real human connections.

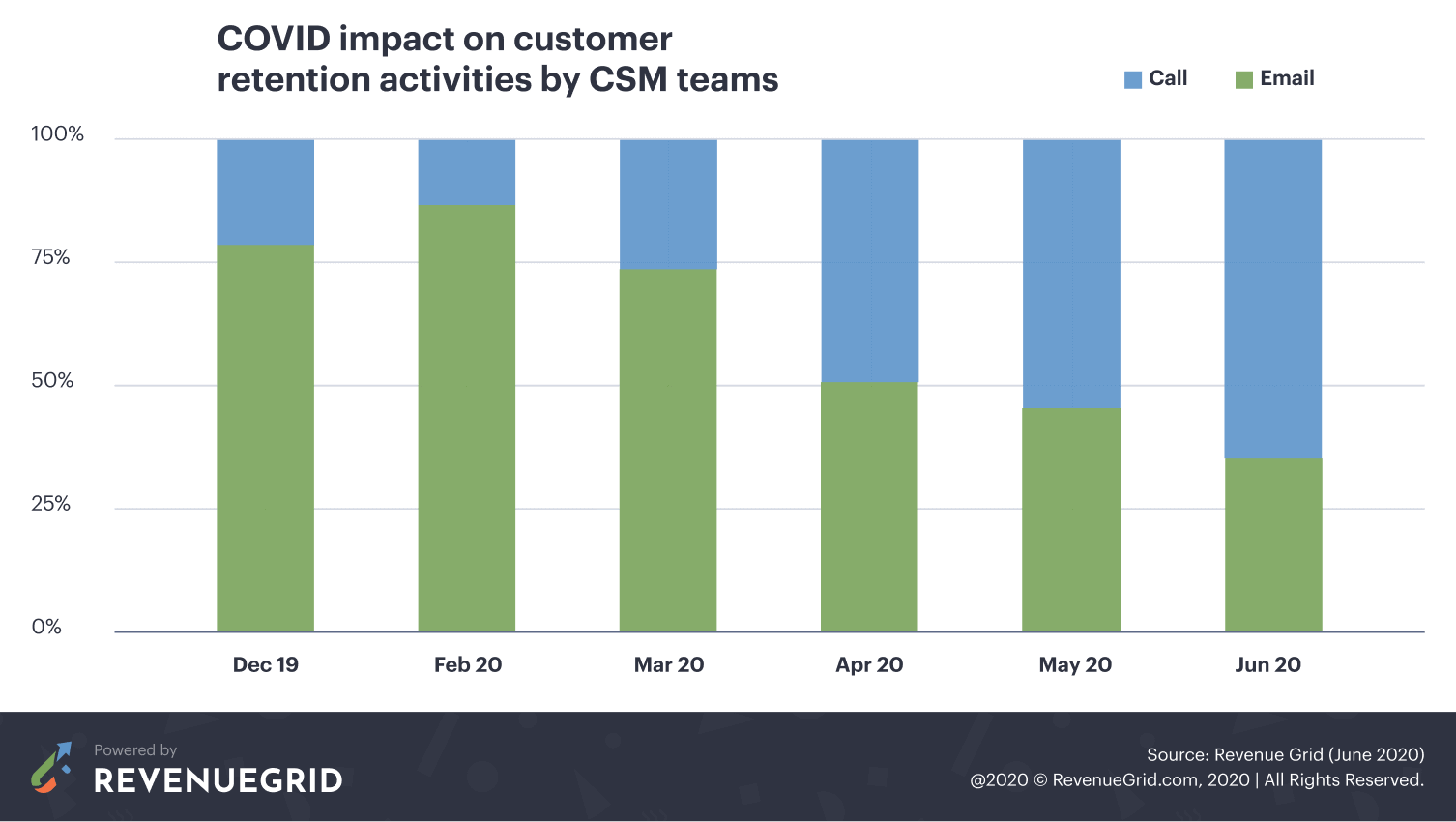

The situation is similar for activities for customer retention.

CSMs and account managers are now making more calls and sending fewer emails.

An era of social isolation and missing human connections has prompted a resurgence in the importance of person-to-person experiences.

The shift from Offline to Online

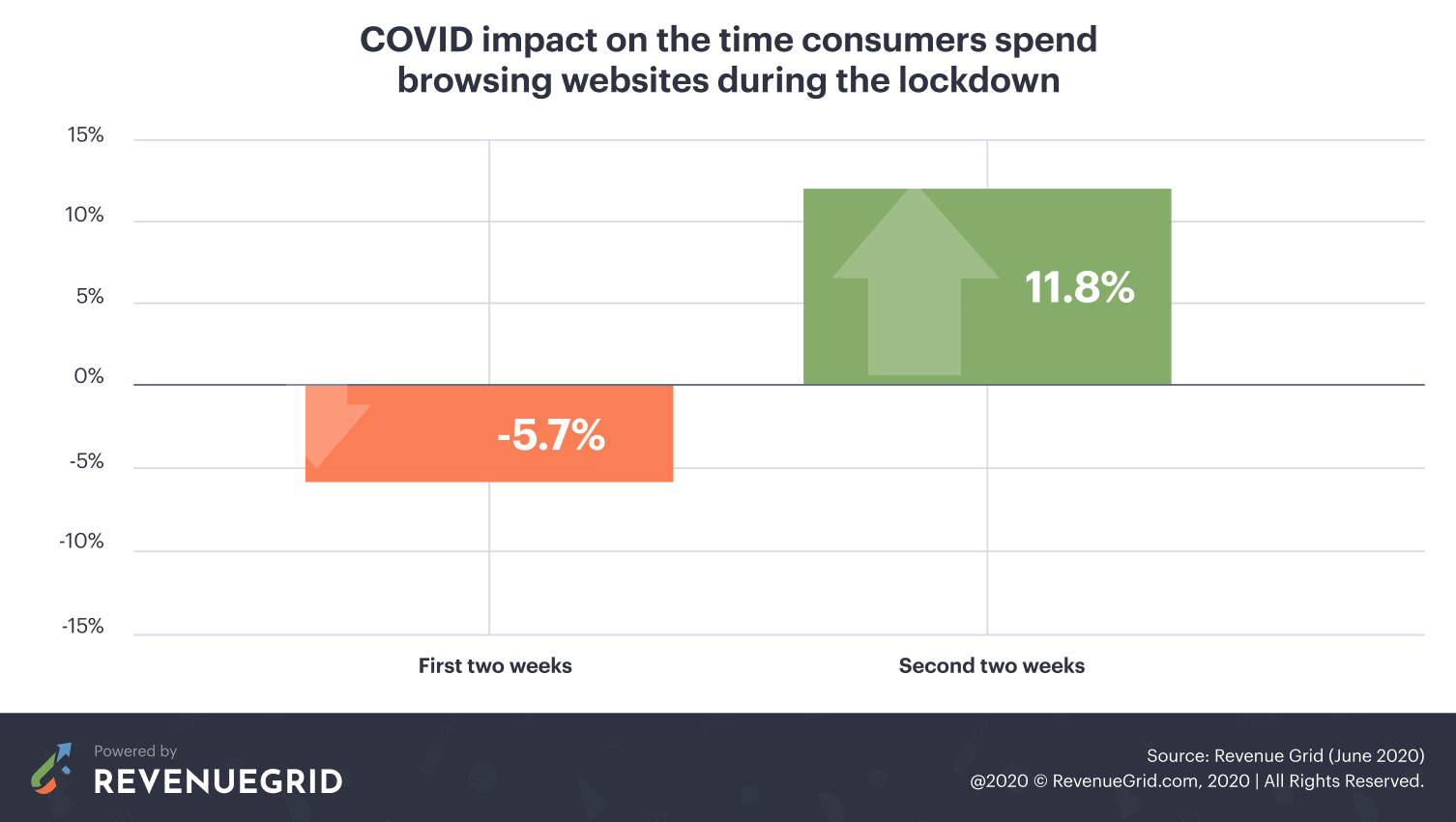

According to ContentSquare reports, customer browsing behavior online is shifting too.

During the early weeks of the pandemic, traffic to B2B SaaS sites fell. During week one and two, traffic dropped by 5.7%.

Between week 2 and 3, however, the traffic increased again by 11.8%. This could indicate that companies began to recognize a new need to enhance their digital strategies for a new environment. Transactions were shifting from the offline environment to online spaces during this time. More purchases, events, and meetings took place online.

The number of hours that consumers spent browsing on these sites increased by 5.8% during weeks 2 and 3.

Changing sales activities after Covid

Further research revealed interesting data on the transforming pipeline, such as:

We learned that churn rates for the fourth quarter of 2019 were at 7%, compared to 3.2% in the same period of 2018.

Additionally, payments declined by 10% between the third quarter of 2019, and the fourth. This indicates a downturn in the amount of cash today’s customers are willing to spend.

This finding was enhanced by insights that payments were postponed 15% more in the fourth quarter of 2019, compared to the third quarter.

Interestingly, sales commissions increased by 10%. This could mean that companies aren’t willing to spend excessively with new companies, but they are willing to spend necessary cash with companies they can trust.

Shifting value propositions

In complex times such as these, businesses everywhere are discovering a critical need to change their approach to sales. Perhaps the most important transition will involve shifting from a focus on revenue, to a determination to show true empathy.

Today’s business leaders need to help their sales teams demonstrate true empathy to prospects and customers. Customers will only be willing to spend money with businesses that show they understand their needs.

Although for some time now, companies have been working hard to provide a “humanized” experience in sales, empathy will be more critical during this time of crisis. We’re living in a world where the economy is suffering and anxiety is rising.

-

15%higher open rate of sales messages that demonstrate the cost and growth benefits of investing in new tools.

-

22%increase in response rate for messages that focus on the users’ values and show both the cost and the outcome of the purchase.

Changes in management style, motivations, and automation

It isn’t just value propositions that are changing either.

Today’s market leaders are discovering that every step that they take towards a conversion needs careful planning and consideration.

Over the last few months, sales teams have started working more consistently from home, leaving traditional offices and events behind. The number of sales activities taking place online is increasing. While this shift towards different working styles delivers excellent solutions for business continuity, it also demands a change in managerial styles.

Sales leaders have to change the way that they manage their teams, which are increasingly remote. New management styles need to consider the needs of an ever-changing landscape, including how to keep remote employees connected.

Practical ways companies are adapting

In the world “After Domestication”, there’s no going back to the old ways of selling.

Sales teams have evolved at a rapid pace to ensure business continuity. As companies begin to return to the office, this demand for transformation won’t stop. The best team leaders have been paying attention to the changes in the landscape, and they’re responding accordingly.

We’re learning that no one wants to spend more money than necessary in this trying time. If sales teams want to overcome the challenge of a suffering economy, they need to show customers a reason to buy. This means shifting value propositions and management styles, while collecting as much information as possible.

For some companies, the future of sales, at least temporarily, will involve things like split and delayed payments to help companies survive. At the same time, as the number of available salespeople continues to fall, managers will have to ensure that the talent they still have is well-supported and empowered.

Going forward, leaders will need to ensure that:

- They’re learning from changes in their pipeline and adapting to industry needs

- They have a broad range of customers – particularly in enterprise

- They’re connecting with their customers in the right ways (calls, social media)

- Empathy is at the heart of every business conversation

- They’re prepared for the demand for online tools in sales

- Management teams can fully support their employees

The changes that we have gathered above are not an emerging trend among sales organizations; the changes have already taken root and are implemented into the businesses’ sales process.

Our sales and product teams here at Revenue Grid have been lucky to witness the lightning-speed adjustments that have occurred across sales teams firsthand. Incredibly, when gathering the data and comparing it to the way that sales teams are actually adapting, we can see that the shifts in statistical data have coincided with the way our customers and prospects conduct their business now. We are indeed living through the birth of a new era.

Here are some of the practical ways that sales organizations have adjusted to the new normal using Revenue Guide’s functionality called Revenue Signals:

– With more calls being made, many companies are leveraging their use of conversational intelligence and setting up signals to act immediately upon hearing a certain keyword during a conversation. This gives them an edge, because they are able to act faster than the competition.

– Many companies have shifted their attention to retention and maintaining strong relationships with their existing customers. To meet those goals, they are setting up signals to monitor the level of happiness in their communication with clients and customizing signals to engage older connections.

– In addition to outreach and nurturing sequences, we are seeing the emergence of a new type of sequence: the relationship health check sequence. Companies are using them to monitor the current state of affairs with a customer and to alert sales and CSM teams about a possible future disturbance while the sky is still blue.

Revenue Signals of the new era

What signals are

“Signals” are a foundational feature of Revenue Guide; they’re alerts to reps and sales leaders sourced from a wide variety of integrated tools and Salesforce data changes.

In unprecedented situations, AI tools fail because they are based on machine learning algorithms trained on data from typical sales cycles—when things are atypical, their guidance isn’t just unhelpful, it could be damaging.

Signals aren’t AI-based, they’re customized by sales leaders based on their unique circumstances. They can be simple or complex. A reminder to reps to follow up a certain number of days after an agreement, or alerts to start email sequences when certain words are mentioned in meetings. Signals are flexible and entirely customizable. Requests for new and altered signals provide us an unparalleled view of the changing style and activities of sales teams AD.