Are you struggling to keep your customers? Have you ever observed an increasing number of customers leaving you recently, and you don’t know why? Chances are, you’re experiencing customer churn.

In this post, we’ll discuss customer churn, how to analyze it, and how to reduce it for your business.

What is Customer Churn?

Customer churn is when a customer stops using a product or service.

There are two main types of customer churn: voluntary and involuntary.

Voluntary churn occurs when a customer chooses to cancel their subscription, usually due to dissatisfaction with the service or product being offered.

Meanwhile, involuntary churn occurs when a customer has been deactivated due to violating company policies or going inactive for too long.

Voluntary churn is typically less expensive than involuntary churn because you can still use win-back strategies to recover them.

What is a Churn Rate?

Churn rate is the percentage of customers who leave your business within a certain period. It can be used to measure the health of your business and identify any areas where you need to make changes to keep your customers around for the long haul.

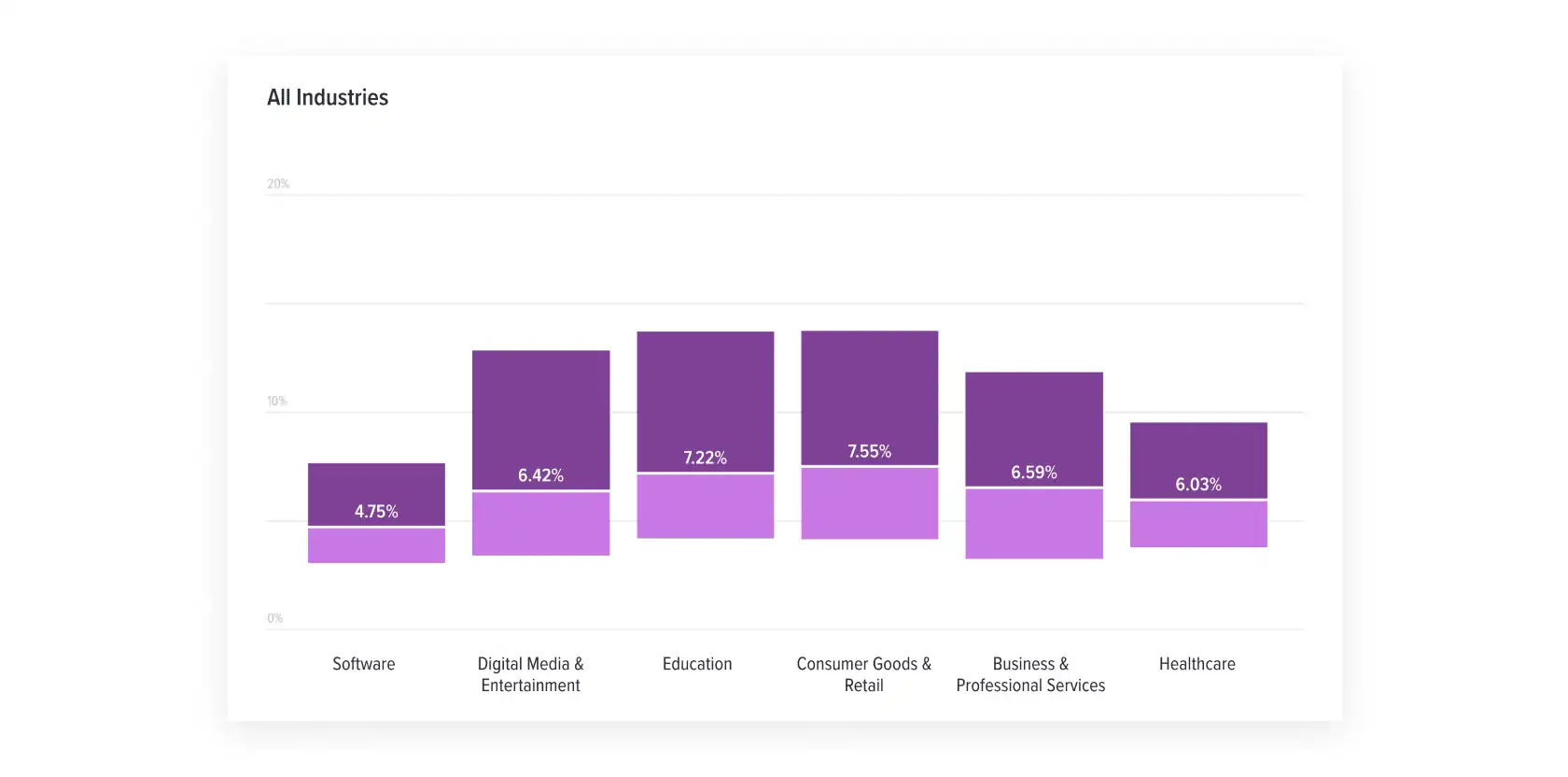

Churn rate can vary depending on the industry, but most companies want to keep their churn rate below 7%.

Churn rate by industry. Source: Recurly

Why is Customer Churn Important?

Customer churn is an important metric because it tells you how well you’re doing at keeping your existing customers happy.

If your churn rate is high, it means people are leaving your business and moving to your competitors. When this happens, you’ll have to spend more money on marketing to acquire new customers in order to maintain business growth.

By looking at customer churn rate, you can understand what’s working and what isn’t in your marketing, sales, and product development efforts.

For example, if you see customer churn suddenly higher, you need to do more to make sure those customers stick around. This could include improving the onboarding process or providing your customer success team with all the resources they need to support those new customers after their purchase.

How to Calculate Customer Churn

You can calculate customer churn by taking the number of customers who have left over a certain period and dividing it by the total number of customers at the beginning of that period.

For example, if you have 100 customers at the beginning of a month and 10 leave during that month, your churn percentage would be 10%.

How to Analyze Customer Churn

Customer churn analysis is a way to measure the number of customers who leave your business and why they left. It’s important because it gives you insight into how you can improve your customer retention strategy.

Here are some ways to analyze customer churn:

- Look at your existing customers: Who are they? Are they brand-loyal? How often do they buy from you? Have they ever left any reviews or mentioned your brand on social media? Once you know this information, you can predict how long they will stay with your company.

- Look at customer churn data: Who are they? Are they all in the same demographic? What products did they buy? Why did they leave? Were there issues with service? Did their needs change over time?

- Calculate churn rate by dividing the number of customers lost during a specific period by the total number of customers at that same time.

- Compare your churn rate against its performance over time and against industry benchmarks.

How to Reduce Customer Churn Rate

If you currently have a high churn rate, consider applying the following tips to reduce it:

- Ensure your products are high quality and fulfill customers’ needs.

- Regularly communicate with your customers about your brand values, product differences, and business updates to maintain relationships.

- Develop a loyalty program for repeat buyers who have purchased from you and offer compelling and relevant incentives.

- Provide outstanding customer service experiences, for example, being attentive when they reach out via phone or email and offer solutions quickly when there are problems.

Revenue Churn vs. Customer Churn

Both customer churn and revenue churn are critical performance metrics. But they measure different things.

Revenue churn indicates how much your business loses when customers stop using your product or service. It’s calculated by dividing the total revenue lost due to customer churn by the total number of customers you have (including new ones).

Customer churn measures how many customers you lose each month. It’s calculated by dividing the number of customers who leave each month by the total number of customers at the beginning of that month

Customer churn can occur for many reasons. But by tracking your churn rate and having effective churn management and retention strategies in place, you can keep this metric under control, retain more customers, and increase your business’s bottom line.