Key Takeaway

- Salesforce pipeline inspection provides real-time visibility, reducing forecasting surprises by tracking deal health, risks, and stage progression continuously.

- Key features include activity tracking, automated alerts, and forecast alignment, ensuring predictable revenue and timely interventions.

- Setting up sales pipeline inspection involves enabling features, customizing views, and training managers for effective data interpretation.

- Revenue Grid enhances pipeline inspection by automating data capture and providing AI-driven insights, transforming monitoring into proactive revenue coaching.

Sales leaders often inspect their pipeline through static reports and scattered sheets. These views only show what has already happened, not what is progressing or at risk right now. This is where forecast errors typically originate, in the “blind spot”. Salesforce pipeline inspection addresses this by giving managers a real-time view of opportunity movement: what has advanced, what is stalled, and what requires intervention.

This guide covers how pipeline inspection works, what it surfaces, how to set it up, which metrics to watch, where it often fails in practice, and how additional tools can extend its value. Used well, inspection turns pipeline views from a static report into evidence-based deal coaching. Revenue Grid adds the missing engagement data and risk signals so managers work from what is actually happening in deals, not delayed CRM updates.

“Did you know? 80% of sales leaders say inaccurate pipeline visibility is their #1 forecasting challenge.”

What Is Salesforce Pipeline Inspection and Why It Matters More Than People Think

Most sales reviews happen after the damage is done, for example: at the end of the month and the dashboards reflect what has already slipped. By the time a red flag shows up in a report, the deal has usually been lost in silence weeks earlier.

Salesforce pipeline inspection exists to prevent that time lag. It watches deal movement in real time so managers can see what advanced since yesterday, what stalled after the last call, and which opportunities are now trending toward risk. Instead of guessing based on memory or gut feel, leaders see the truth while there is still time to act.

The truth is that the blind spot is not merely theoretical. In global sales organizations, it’s often wherein late-stage deals look safe in Salesforce but had already gone cold when external signals were pulled in.

This kind of shift in perception benefits CROs who care about forecast accuracy, frontline managers who coach deals mid-flight, RevOps who police data hygiene, and sales representatives who would rather course-correct early than explain misses later.

To act on that live visibility, you need features inside Salesforce that track change, expose risk, and prompt action. That’s what Pipeline Inspection delivers, here are the key features.

| Solution | Support Status | Key Features | Limitations | Best For |

|---|---|---|---|---|

| Salesforce for Outlook (Legacy) | Retired June 2024 | Desktop application, Basic sync, Email tracking | No longer supported, Security vulnerabilities, Limited functionality | Migration required — not recommended |

| Native Outlook Integration | Active Support | Cloud-based, Einstein Activity Capture, Basic email logging | Limited customization, Sync delays, Storage constraints | Small teams, Basic integration needs |

| Third-Party Tools (Revenue Grid) | Full Support | Advanced automation, Real-time sync, Custom workflows, Mobile support | Additional cost, Setup complexity | Enterprise teams, Advanced automation needs |

Key Features of Salesforce Pipeline Inspection

Static pipeline reviews often tell you what the pipeline looked like days ago. Deals move, stall, and slip in silence between meetings. Pipeline inspection replaces that lag with a live window into how opportunities are changing right now.

Real-time visibility (Salesforce pipeline)

- Pipeline inspection tracks deal movement continuously, not just at quarter-end or before forecast calls. Instead of debating memory or stale numbers, managers walk into reviews with fresh truth.

- It shows what moved since the last touch in real time. This helps managers intervene during movement, not after miss and reduces reliance on manual exports and stitched spreadsheets.

Deal health indicators

- A pipeline full of “open” deals is not a healthy pipeline. Inspection surfaces risk signals early like long silence, aging in stage, abnormal push behavior, before they calcify into losses.

- It also flags stale deals based on inactivity and time-in-stage and surfaces at-risk opportunities for early coaching.

Activity tracking

- A deal with no buyer engagement is a deal in decline. Inspection ties opportunity health to logged activity so managers can see evidence, not assurances.

- It also auto-captures calls, emails, meetings tied to the deal and removes dependency on reps to remember to log activity. This helps give you clarity on whether “it’s moving” is fact or fiction.

Explore how Salesforce users can elevate their engagement strategy beyond just pipeline visibility. Dive into our detailed guide on Salesforce Engage.

Stage progression insights (Salesforce pipeline stages)

- Bottlenecks rarely show in a total pipeline number. They show up in how deals move through stages, or rather fail to. Inspection exposes where and why deals drop.

- Also highlights low-conversion stages with trend visibility and shows where stalls repeat across reps or segments. This helps refine the sales process where movement breaks

Forecast alignment

- Forecasts fall apart when they are fed by hope, not evidence. Inspection ties live movement to forecast categories so leaders see what is actually commit-worthy.

- It connects opportunity changes to Commit/Best Case/Pipeline and helps identify forecast gaps before the quarter closes.

Automated alerts

- No manager has the time to monitor every deal manually. Alerts make sure problems surface even when no one is looking.

- Alerts are also available for stalled deals and repeated date pushes. This surfaces risk proactively before it contaminates the forecast and keeps leadership informed without manual checking.

| Feature | Pain Point Solved | Benefit to the Team |

|---|---|---|

| Real-time visibility | Static reviews show outdated pipeline; movement happens between meetings | Managers walk into reviews with fresh truth and intervene during movement, not after losses |

| Deal health indicators | “Open” deals look healthy even when they are silently decaying | Risk is surfaced early (silence, age, pushes) so managers can coach before deals die |

| Activity tracking | Deals look active based on rep claims, not evidence | Engagement is tied to logged behavior and auto-captured so health reflects reality |

| Stage progression insights | Pipeline size hides bottlenecks; stalls only show up in hindsight | Shows exactly where deals drop or stall so process fixes are targeted, not generic |

| Forecast alignment | Forecasts are padded by hope and stale deals | Live movement ties back to Commit/Best Case so leaders see what is actually winnable |

| Automated alerts | No one has the bandwidth to manually patrol every deal | Risk surfaces on time (stalls, pushes, regression) without manual hunting or inspection cycles |

With the “what” covered, let’s move to the “how”. Configure Salesforce Pipeline Inspection with the steps below.

Step-by-Step Guide to Setting Up Pipeline Inspection in Salesforce

Knowing what pipeline inspection is doesn’t fix anything by itself. The value comes only when it is set up with intention. It is not just “turned on,” but configured so the data that appears is actually useful in reviews. The steps below are not technical instructions; they are the operational moves that determine whether your team gets noise or insight.

1) Enable Pipeline Inspection

Turn the feature on from Salesforce Setup. This unlocks the inspection panel, movement tracking, and health indicators inside the Salesforce pipeline.

- Available on Enterprise and Unlimited editions

• Required to expose the inspection UI and movement metrics

• Do this first before any configuration work begins

2) Configure Opportunity List Views

Inspection is only as useful as the list it sits on. Create focused list views for “This Quarter,” “High-Value Deals,” or “Late-Stage Deals.”

- Add only fields needed for weekly decisioning (Owner, Stage, Close Date, Amount)

• Avoid clutter because long list views slow adoption

• Segment views by intent (forecast vs coaching vs risk scan)

3) Select Key Fields

Inspection reads whatever you expose. Start with high-signal fields like Stage, Last Activity Date, Deal Age, Forecast Category.

- These drive health flags and movement signals

• Fewer fields = faster interpretation in live conversations

• Expand only after reps and managers adopt the first set

4) Set Forecast Categories

Tie opportunities to Commit, Best Case, or Pipeline so inspection aligns with revenue expectations, not just deal status.

- Makes reviews forecast-linked, not anecdote-linked

• Normalizes definitions across teams

• Reduces friction in forecast calls

5) Train Managers on Interpretation

Inspection is wasted if managers read it like a spreadsheet. Teach them what to look for: stalling, inactivity, regression, silent deals, stage decay.

- Enable coaching on movement, not on opinions

• Use real examples from current pipeline in training

• Make this mandatory before rollout to reps

6) Integrate Activity Capture

Connect calendar and email so engagement data is logged automatically. That makes inspection trustworthy and eliminates the “rep forgot to log it” excuse.

- Captures calls, emails, meetings without manual effort

• Produces a complete engagement timeline for each deal

• Pilot with a small cohort before pushing it out across the organization

📌 Pro Tip

Start with 5-6 fields and metrics. Expanding too early creates noise and slows adoption.

Essential Pipeline Inspection Metrics Every Sales Team Should Track

Pipeline inspection only produces meaningful coaching when leaders know what to look at, not just what exists. These metrics expose movement quality instead of volume, so managers intervene before deals expire quietly in the CRM.

Opportunity age

If a deal has been “alive” for too long, it usually isn’t alive — it’s abandoned without being marked closed. Most “surprise losses” were actually slow deaths disguised as open deals.

• Set age thresholds (>60 days) to force review

• Separate “active” from “parked” pipeline

Stage duration

Healthy deals move. Stuck deals teach you where the system is failing — messaging, approval friction, pricing, or rep skill. Slow stages are coaching signals.

• Compare stalled deals to “fast wins” to isolate bottlenecks

• Tune exit criteria or messaging based on patterns

Last activity date

Silent deals rarely close. When nothing has happened for days or weeks, the buyer has usually moved on mentally even if Salesforce still shows “late stage.”

• Set alerts for inactivity beyond a threshold

• Use it in 1:1s to enforce momentum discipline

Close date pushes

When reps keep sliding the close date forward, they aren’t forecasting — they’re preserving optics. This is the fastest way bad data poisons a forecast.

• Track average pushes per rep

• Exclude multi-push deals from commit unless justified

Win rate by stage

Deals don’t die randomly, they die in patterns. Stage-to-stage conversion shows exactly where revenue leaks.

• Aim enablement at the weakest conversion stage

• Use conversion to refine qualification rules

Pipeline coverage ratio

Many teams debate performance when math already shows they can’t hit the number. Coverage is the truth before execution even begins.

• Trigger pipe-gen when coverage drops

• Use it to inform territory and resourcing calls

Even with strong habits, native Salesforce inspection has structural limits that cap how far it can take a team.

Limitations of Native Salesforce Pipeline Inspection

Pipeline inspection solves the visibility problem, but it does not solve the completeness or intelligence problem. The view is only as strong as the data and context flowing into it and that is where the native tool hits its ceiling.

- Manual data dependence: Inspection still depends on reps updating fields accurately and on time. If data is stale, the “insight” is stale and movement signals collapse when updates are skipped.

- Limited predictive intelligence: Salesforce shows the state of deals and not the probability of their future. Forward-looking risk scoring is absent and there is no AI-driven coaching or next-best action.

- Customization gaps: Complex deal motions (multi-threading, buying groups, partner touches) often exceed default fields and layouts. It requires admin-heavy customization to reflect and is hard to adapt for non-linear or multi-entity sales cycles

- Fragmented engagement signals: Not all buyer activity lives inside Salesforce by default. LinkedIn, WhatsApp, offline calls, or external sequences are easily missed and engagement context becomes partial, not full.

Those gaps create blind spots that native inspection alone can’t close. This is why teams layer advanced pipeline analytics on top.

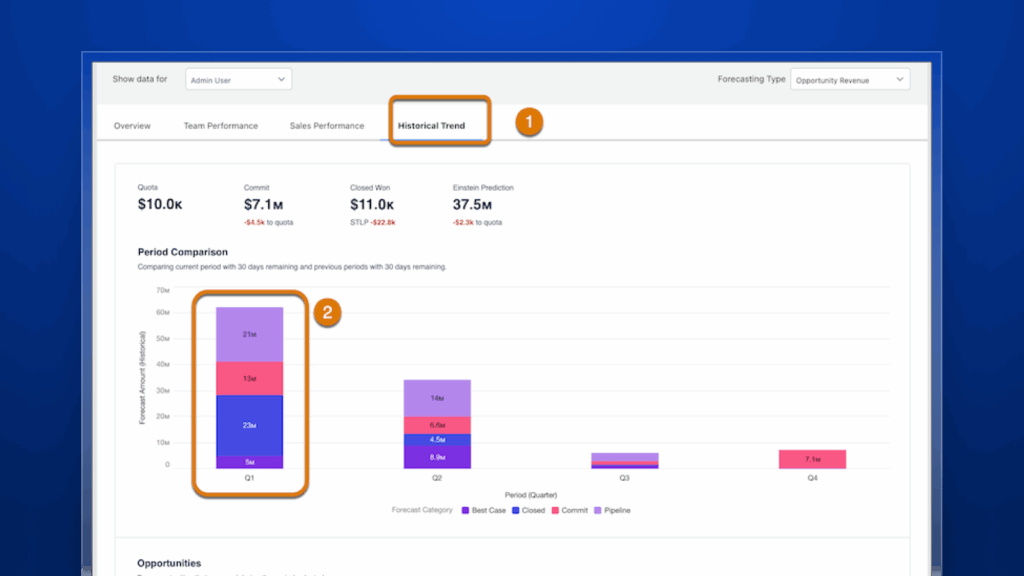

Advanced Pipeline Analytics: Beyond Basic Inspection

Native inspection tells you what is happening. Advanced analytics go further. They explain why it is happening, how it will trend, and what action to take before the forecast breaks.

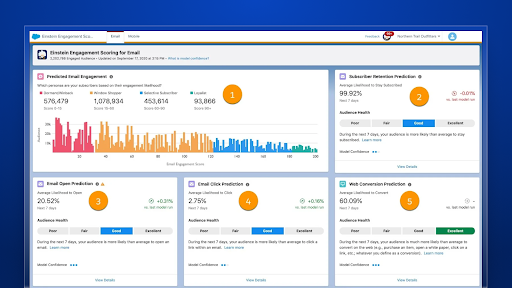

- AI-powered forecasting: Predicts close likelihood using historical patterns and current behavior, not rep confidence. It identifies false-positives early and strengthens commit accuracy.

- Engagement scoring: Measures the quality and intent of interactions, not just the count of logged touches. It differentiates noise from meaningful buyer signals and improves coaching around deal momentum.

- Historical trend analysis: Tracks pipeline inflow, outflow, velocity, and regression over time, not just status at a single moment. It exposes systemic weaknesses versus one-off anomalies and helps with planning and resource allocation.

- Scenario planning: Models “what-if” cases to stress test the forecast before reality exposes the gaps. It supports best-case and worst-case planning and prepares leadership for board-level forecast scrutiny.To turn these analytics into real-time coaching and deal execution, teams use Revenue Grid.

How Revenue Grid Supercharges Salesforce Pipeline Inspection

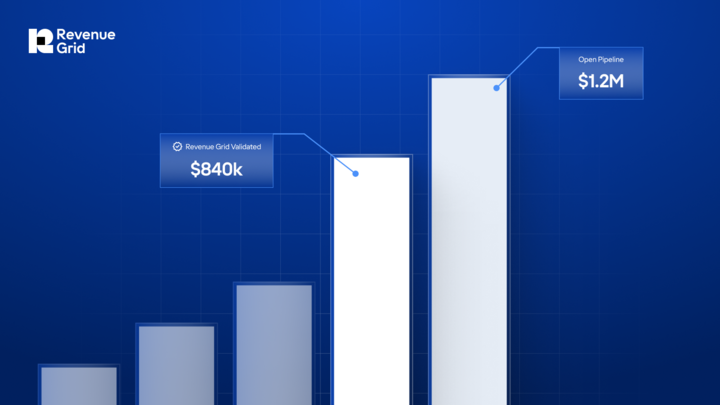

Salesforce inspection gives visibility. Revenue Grid gives truth and actionability by fixing the data gaps, surfacing risk automatically, and guiding execution without waiting for reviews.

Automated data capture

Revenue Grid records emails, meetings, and calls automatically so inspection reflects reality, not rep input discipline.

• Removes manual logging and backfilling

• Captures engagement across all active accounts

• Creates a reliable engagement history for every deal

Revenue signals

AI reads conversations and activity patterns to surface signals like stalled motion, competitor triggers, or engagement drops, without manual digging.

• Raises risk before forecast calls, not after

• Surfaces threats and rescue plays in real time

• Exposes repeatable patterns that point to process fixes

For example, a SaaS sales team discovers that nearly 40% of its “late-stage” deals have gone 18+ days without any engagement until revenue signals flag them.

Guided selling playbooks

Signals don’t just alert, they provide suggestions. Revenue Grid includes next steps into the workflow: who to contact, with what message, and when.

• Gives new reps a fast, repeatable path

• Keeps veterans consistent under pressure

• Adapts guidance as deal signals shift

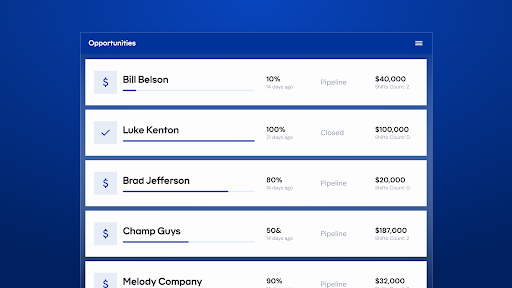

Comprehensive deal intelligence

Instead of reading Salesforce fields in isolation, Revenue Grid fuses CRM data with live engagement data to show deal truth, not deal posture.

• Distinguishes “logged pipeline” vs “real pipeline”

• Flags quiet but high-value exposure

• Helps leaders prioritize the right deals at the right time

In some cases, the pipeline looks healthy on paper, but inspection plus engagement intel reveals that the top accounts had zero executive participation. These kinds of silent risks are not visible in Salesforce alone.

Boosted forecast accuracy

Forecasts are strengthened with predictive AI using velocity, engagement, and historical win patterns.

• Catches revenue gaps earlier

• Improves confidence in commit decisions

• Directs managers toward winnable opportunities first

📌 With Revenue Grid, pipeline inspection shifts from reactive monitoring to proactive revenue coaching.

Who should use Salesforce pipeline inspection?

It is most valuable for CROs, RevOps, and frontline managers who need forecast accuracy and early visibility into risks before deals slip.

Does Salesforce pipeline inspection work for all editions?

No. It is included only in Enterprise and Unlimited editions. Professional edition users would need to upgrade or consider external tools for pipeline visibility.

How often should teams review pipeline inspection dashboards?

A weekly review is enough for most teams. High-velocity teams may benefit from brief daily checks to act on risks sooner.

Can pipeline inspection replace sales forecasting?

No. Forecasting predicts outcomes; inspection shows current deal health. They are complementary and deliver the best results when used together.

What mistakes should be avoided when using pipeline inspection?

Common issues include incomplete CRM updates, tracking too many fields at once, and failing to coach reps on the insights surfaced.

Is pipeline inspection customizable?

Yes. Fields and views can be tailored. But advanced customization for complex motions often requires tools like Revenue Grid.

What are the key stages of a sales pipeline?

Typical stages include Prospecting, Qualification, Proposal, Negotiation, and Closed Won/Lost. Tracking these stages clarifies where deals are moving or getting stuck.

How do I identify and fix stalled deals in my pipeline?

Watch for inactivity, long time-in-stage, or repeated close date pushes. Revenue Grid’s Revenue Signals can flag these automatically so managers can respond quickly.

Can I connect email and calendar data to Salesforce pipeline inspection?

Yes. Integrations with Salesforce or Revenue Grid allow automatic capture of emails, calls, and meetings, giving a full view of engagement without manual logging.