Key Takeaway

- Teams switch from Gong not because of weak call intelligence, but because the gaps around it: pricing jumps, Salesforce storage load, adoption friction, and data portability, compound over time.

- The best Gong alternatives are the ones that capture the entire sales motion, not just conversations: cross-channel activity, deal engagement, and forecasting signals.

- Revenue Grid stands out for its Salesforce-native architecture and unified approach across activity capture, signals, forecasting, and deal execution.

- Clari attracts enterprise teams that need structured, disciplined forecasting above everything else.

- ZoomInfo Chorus appeals to teams that want deep call analytics enriched with buyer and intent data.

- People.ai fits organizations prioritizing exhaustive activity capture, though it adds operational overhead.

- Aviso suits mature RevOps orgs that treat forecasting as a strategic modeling exercise, not a reporting function.

Why Sales Teams Are Leaving Gong

Most teams don’t start looking for Gong alternatives because it fails at call intelligence. They start looking when the surrounding friction for sales reps becomes harder to ignore. As you read through Reddit threads, G2 reviews, and Capterra feedback related to customer success, the same sequence shows up again and again: pricing shocks, Salesforce impact, adoption issues, and locked-in data.

It often starts at renewals. Teams that signed in the $150–$170 per-user range suddenly receive renewal quotes landing between $230 and $250. Many say they were offered bundles they never asked for. One G2 reviewer put it bluntly: “Renewal was nowhere close to the initial quote.” That’s usually when RevOps gets pulled into Finance conversations they didn’t anticipate and when the first search for Gong competitors begins.

Once pricing becomes a concern, teams naturally look at where value is supposed to show up: Salesforce. That’s when Salesforce admins start noticing the storage spike. A Salesforce admin on Reddit reported nearly 25MB of data/day coming from Gong’s writebacks, roughly 12,000 records daily. For teams with high call volume, storage costs climb even before renewal discussions start.

The surprise is not the volume of data; it’s the lack of upfront clarity about the impact. This is exactly where activity capture that doesn’t inflate Salesforce storage becomes a real differentiator.

Then comes usability. Reviewers often describe Gong as powerful but not intuitive, especially when it comes to advanced conversation intelligence features. Reps struggle to locate calls. Onboarding takes longer than planned. Adoption lags, which affects sales coaching and forecasting workflows.

Once teams decide to switch, one final obstacle appears: there’s no bulk export for calls or transcripts. Years of data have to be pulled manually.

Any one of these issues is manageable on its own. It’s the combination: pricing, storage impact, sluggish adoption, and locked-in data that pushes teams to reevaluate the entire setup.

What Makes a Superior Revenue Intelligence Platform

Once you begin evaluating Gong alternatives, the criteria quickly shift from key feature lists to operational reality. The most reliable sales engagement platforms tend to excel in three areas:

1. Deep Salesforce integration

This is the first non-negotiable. RevOps leaders call it the deciding factor because data accuracy, forecasting, and rep performance all depend on how closely a platform behaves like part of Salesforce. When it doesn’t, the same problems repeat themselves:

- Sync delays that distort pipeline reviews,

- Storage inflation from thousands of auto-generated records, and

- Broken Flows or reports because activities sit in non-standard objects.

One Salesforce admin said their team hit storage limits months early because the tool created “records for everything.” Platforms built to mirror Salesforce’s data model avoid this, delivering real-time insight, predictable storage, and cleaner pipeline visibility.

However, solving data reliability only exposes the next question: do you actually see what happens between those logged touchpoints?

2. Multi-channel knowledge capture

Logged activities alone aren’t enough. You need knowledge capture that keeps all interactions tied to the right opportunity. The right revenue intelligence platforms capture the full story across sales channels: email intent shifts, meeting outcomes, stakeholder involvement, shared files, and past engagement patterns that explain where deals stall.

The best Gong alternatives also surface new contacts created through customer interactions, not just those manually added to Salesforce.

When this works, reviewers report saving five to six hours a week per rep because they’re no longer rewriting conversations into the CRM.

Once teams experience that, the next priority becomes obvious: will reps actually use the platform?

3. User adoption and workflow fit

Every migration story includes a version of: “The tool was powerful, but reps avoided it.” That’s why usability becomes the real differentiator.

High-adoption platforms share three traits reviewers consistently highlight:

- Search that works. Reps can pull up calls by keyword, deal, or stakeholder instantly

- Coaching insights in the right place. Inside Salesforce, not buried in a separate UI

- Minimal retraining. Workflows that match how reps already work

One sales manager noted that their previous platform “looked great in demos but took months for reps to use confidently.” Tools that integrate cleanly into existing processes see adoption rise faster, which directly improves forecasting, coaching, and deal movement.

Here’s the catch: very few platforms deliver even two of these requirements well. Which is why, once you filter for Salesforce-depth, true multi-channel insight, and high rep adoption…the shortlist tightens quickly.

Top 5 Gong Competitors

Teams evaluating Gong alternatives usually end up comparing these five platforms: Revenue Grid, Clari, ZoomInfo Chorus, People.ai, and Aviso. Each solves a different part of the revenue intelligence problem, and understanding those differences upfront saves weeks of back-and-forth with vendor calls.

| Platform | What it does best | Integration capabilities | Pricing overview |

|---|---|---|---|

| Revenue Grid | Salesforce-native revenue action platform with unified CI, forecasting, and real-time revenue signals | Fully native to Salesforce with no API sync delays; Outlook and Gmail extensions | Activity Capture 360 ($30/user/month); Knowledge Capture ($49/user/month); Revenue Grid Ultimate ($149/user/month) |

| Clari | AI forecasting, pipeline visibility, structured deal governance, and conversational intelligence (CI) | API-based Salesforce sync; email and calendar integrations; not CRM-native | Custom pricing; typically on the higher end due to separately priced modules |

| ZoomInfo Chorus | Deep conversation intelligence enriched with ZoomInfo intent and buyer data | Connects to Salesforce, Microsoft, Google Workspace, and the ZoomInfo ecosystem | Custom pricing; increases when bundled with ZoomInfo data products |

| People.ai | Enterprise-grade activity capture and account intelligence across emails, meetings, calls, contacts, and buyer roles | API-based Salesforce sync; email and calendar integrations; heavy data ingestion | Custom quote; cost rises with activity volume, seats, and dataset size |

| Aviso | AI-guided forecasting, scenario modeling, pipeline inspection, deal intelligence, and conversation intelligence | API integrations with Salesforce, Microsoft, Outreach, and Salesloft | Custom pricing; positioned at the premium tier given its AI-heavy architecture |

Caption: Comparison table of five leading Gong alternatives outlining strengths, limitations, and ideal use cases.

With the high-level differences established, the next step is to break down each competitor: what they actually deliver, how they perform in real workflows, and how they compare to Gong when sales teams evaluate switching.

Revenue Grid

Best for: Salesforce-native organizations prioritizing rapid deployment and data integrity.

Cost: Activity Capture 360 ($30/user/month); Knowledge Capture ($49/user/month); Revenue Grid Ultimate ($149/user/month).

Ease of use: Since Revenue Grid operates inside Salesforce, teams don’t have to learn a new system or manage sync-heavy integrations. Everything—signals, coaching, forecasting, and activity timelines—lives where reps already work.

Total cost of ownership: Lower long-term operational cost since there’s no sync maintenance, no unexpected Salesforce storage usage, and no engineering oversight required.

When Revenue Grid tends to be the better choice

Most teams choose Revenue Grid when they’re tired of wrestling with data accuracy inside Salesforce. Once they switch, the first change they notice is how much cleaner their CRM becomes. Because the platform is fully native, there’s no API sync layer creating delays, duplicates, or unexpected storage usage. The system simply behaves the way reps expect it to, and day-to-day work becomes easier as a result.

That stability sets up the rest of the experience.

Pipeline reviews start making more sense because movement is tracked in real time, not patched together from multiple dashboards. True Pipeline helps managers see which deals advanced, which ones stalled, and where stakeholder gaps formed. The conversation becomes more factual and less about hunting for missing context.

Reps feel a similar shift. Deal guidance appears directly inside Salesforce. They see alerts about slow responses, weak multithreading, or stages that haven’t changed in days, where the work happens, so follow-ups happen earlier and with less friction. Meeting Assistance follows the same pattern: calls, transcripts, and coaching notes sit on the opportunity record instead of in a separate tool.

When it comes to pricing, Revenue Grid offers flexible, transparent plans aligned to specific module needs: CI, sales forecasting, pipeline visibility, or revenue signals. Thanks to its Salesforce-native ecosystem, customers avoid the “surprise” costs associated with syncing large volumes of data or buying additional storage.

General pricing structure:

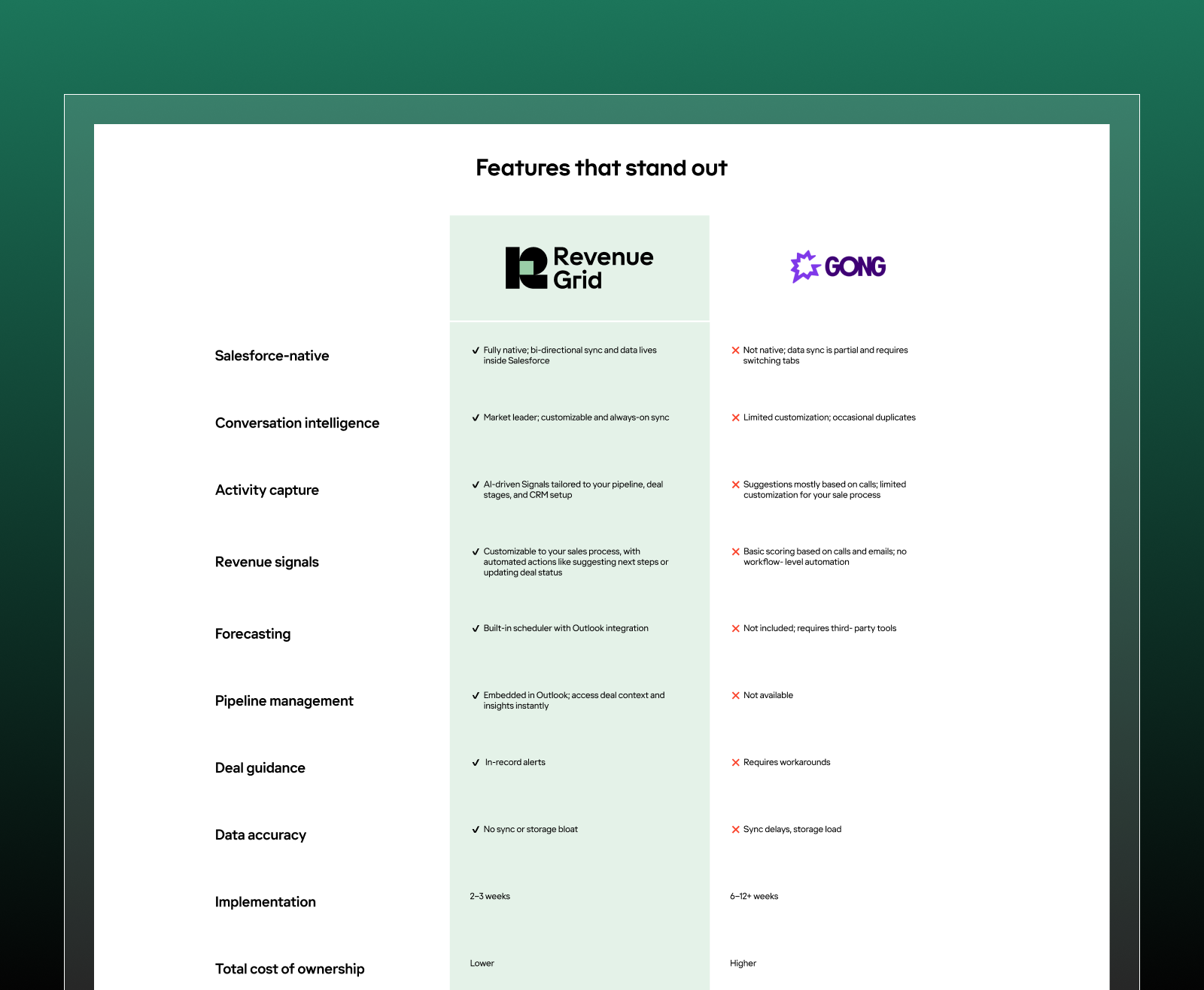

Features that stood out

Comparison of Revenue Grid and Gong across core sales and Salesforce capabilities.

Clari

Best for: Enterprise revenue teams where forecast accuracy and disciplined pipeline governance are non-negotiable.

Cost: Custom pricing. Typically higher for organizations adopting multiple forecasting and pipeline modules; cost scales with user count and activity volume.

Ease of use: Clean, structured interface built for leaders and RevOps teams who run disciplined forecasting cycles.

Total cost of ownership: Higher than most competitors due to modular pricing and ongoing admin oversight for integrations and sync health.

Clari stands out to teams that treat sales forecasting as a core operational discipline. Its strength comes from how it structures commit, upside, and risk categories and brings CRM, email, and meeting activity into one consolidated view. For large or distributed sales orgs, this creates a consistent, predictable cadence for forecast reviews.

Enterprise teams also value Clari’s rollup framework. It aligns regional, segment, and global forecasts into one unified view, reducing the fragmentation that often slows down weekly sales calls.

The tradeoffs surface operationally. While Clari integrates tightly with Salesforce and markets a “Salesforce-native architecture,” it still runs outside the CRM and relies on API syncs. During heavy activity periods, RevOps teams frequently manage sync health, field mappings, and storage thresholds to keep data aligned. Pricing can also grow quickly because forecasting, pipeline visibility, analytics, and Copilot (CI) sit in separate modules.

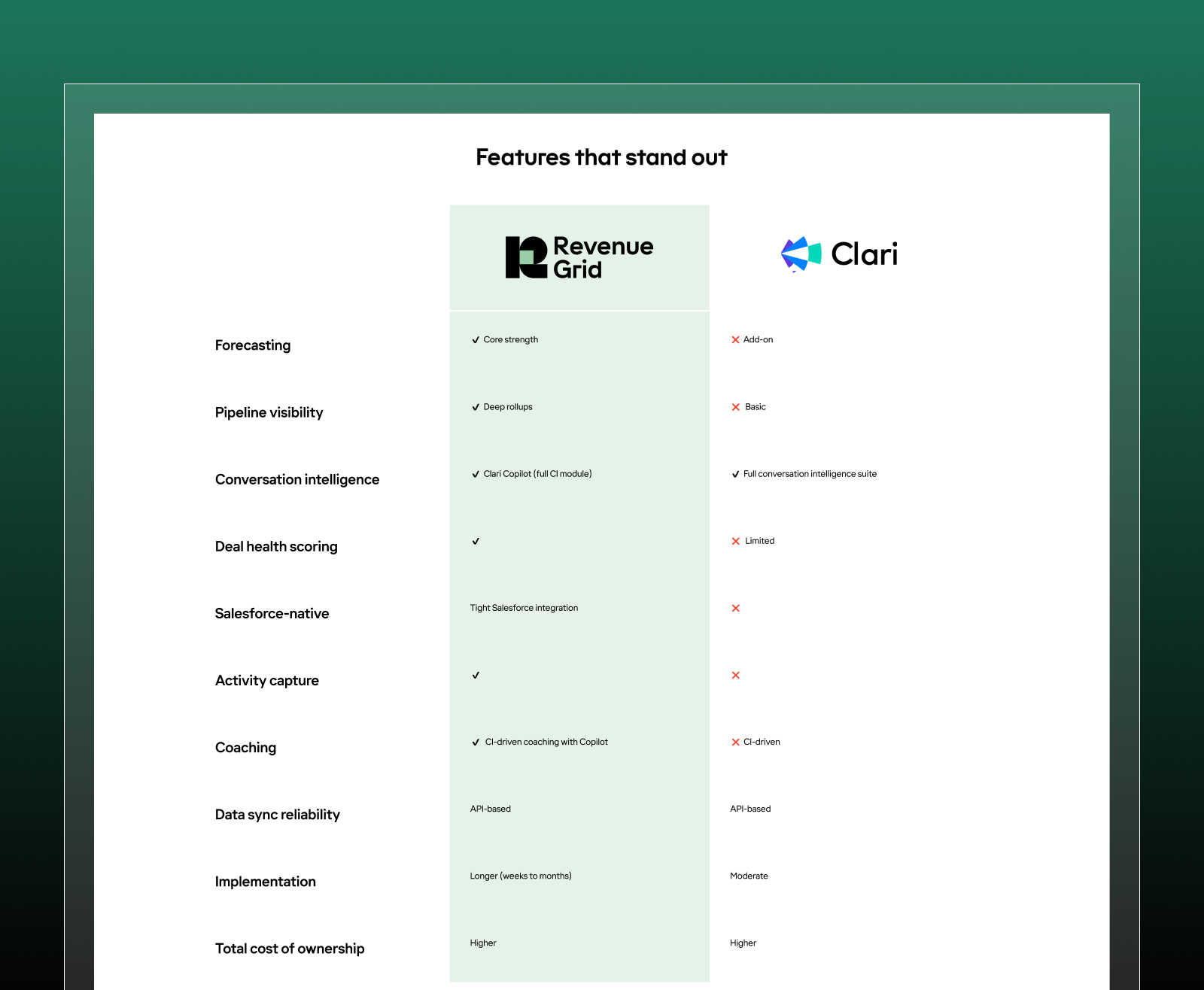

Features that stand out

Revenue Grid vs Clari: A quick view of how structured forecasting compares with call-focused insight.

ZoomInfo Chorus

Best for: Teams that want deep conversation intelligence enriched with ZoomInfo’s intent and buyer data.

Pricing: Fully custom; costs rise when paired with ZoomInfo’s data, workflows, or automation add-ons.

Ease of use: Designed for fast call review and structured coaching.

Total cost of ownership: Higher for teams expanding into the broader ZoomInfo ecosystem; best suited for orgs already using ZoomInfo.

Chorus appeals to teams that treat every call as a data source. Managers get clean transcripts, sharp topic breakdowns, and coaching workflows that make it easier to develop SDRs and AEs. The real advantage shows up when Chorus ties into ZoomInfo’s intent and firmographic data. Calls become more than conversations; they become context. Teams can see a prospect is active, not just how the call unfolded.

For discovery-heavy motions, Chorus often becomes the center of coaching. Managers track questioning patterns, spot positioning misses, and measure improvements over time. Teams already prospecting inside ZoomInfo see the strongest lift, because the platform reinforces their sourcing and qualification efforts.

The limitations appear when teams look for broader workflow coverage. Chorus handles calls exceptionally well, but it stops there. There’s no sales collaborative forecasting, deal progression view, and way to connect small engagement gaps to pipeline risk. Since it runs outside Salesforce, RevOps teams sometimes notice timing discrepancies between ZoomInfo and CRM activity during high-volume weeks.

The result is simple: Chorus excels at call intelligence, but it needs another platform beside it to complete the revenue picture.

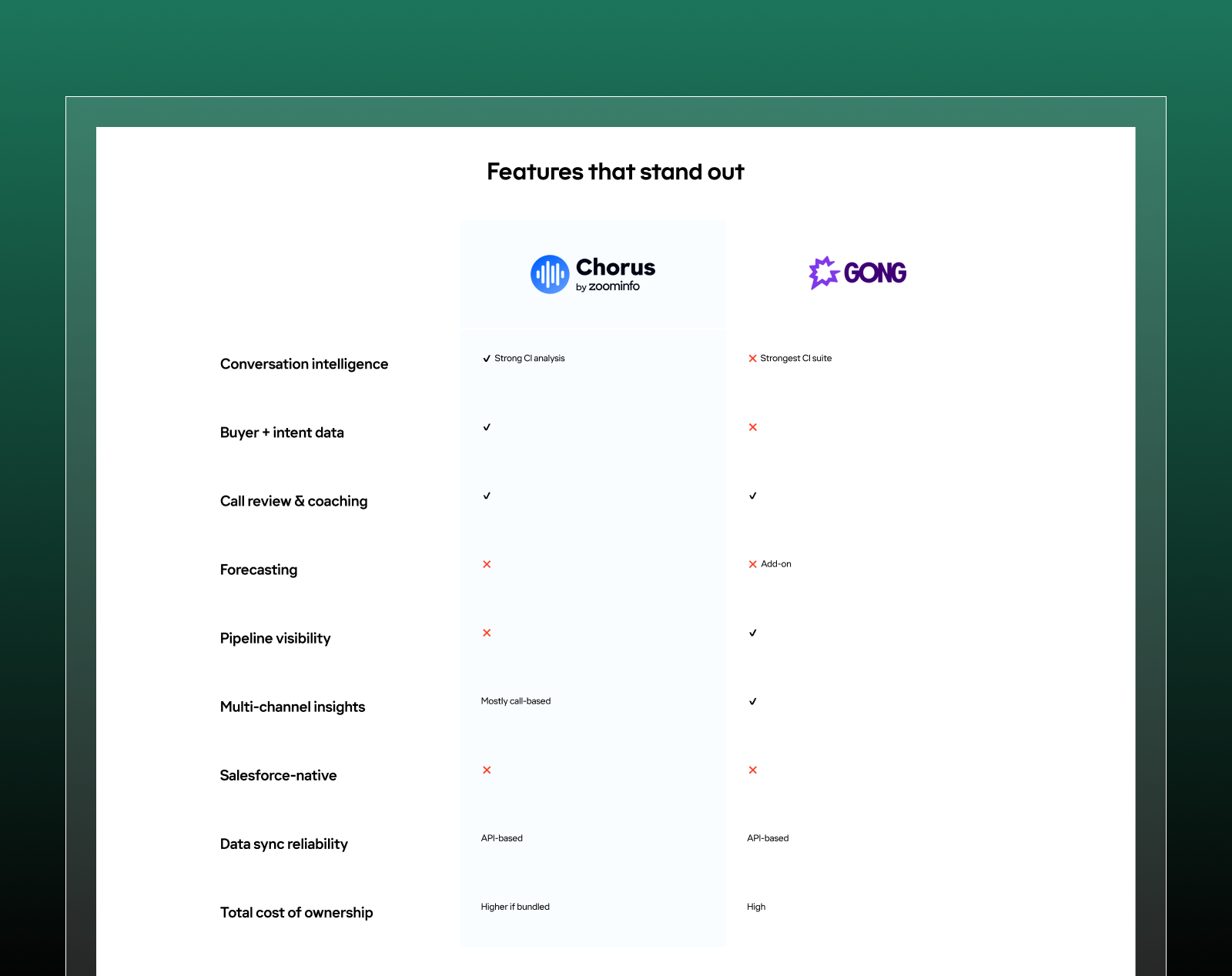

Features that stand out

ZoomInfo Chorus vs Gong: Snapshot of how call intelligence changes when buyer and intent data enter the mix.

People.ai

Best for: Teams that want every email, meeting, and touchpoint captured automatically.

Pricing: Custom quotes; cost increases with activity volume and org size.

Ease of use: Built for RevOps and leadership; less intuitive for reps who prefer in-CRM guidance.

Total cost of ownership: Higher for large activity volumes due to storage impact and ongoing admin oversight.

People.ai appeals to organizations that can’t afford blind spots in their CRM data. Among Gong competitors focused on revenue intelligence, it stands out for its ability to capture every email, meeting, call, and contact with precision. This level of Salesforce activity capture gives RevOps a complete picture of the account and helps leaders map engagement to deal progression more reliably than manual logging or partial ingestion.

Its predictive scoring engine is another advantage. By highlighting patterns reps often overlook, People.ai helps managers surface risk earlier, especially in long sales cycles where missing stakeholders or low engagement can derail a deal quietly. For teams comparing People.ai vs Gong, this data-driven deal insight becomes a deciding factor.

The trade-off shows up in operations. As an API-based sales intelligence tool, People.ai requires ongoing oversight. RevOps teams frequently monitor storage usage, field mappings, sync queues, and ingestion rules to keep Salesforce data accurate. Since many insights sit outside Salesforce, reps must toggle between tools, a common friction point across Gong alternatives that aren’t CRM-native.

Features that stood out

People.ai vs Gong: Where full-funnel activity capture meets real-world operational overhead.

Aviso

Best for: Enterprise revenue teams that need advanced AI forecasting, scenario modeling, and deep risk scoring.

Pricing: Fully custom; generally higher due to AI modeling and multi-system data ingestion.

Ease of use: Designed for leadership and RevOps users who want structured forecasting and data-backed assessments.

Total cost of ownership: Higher because implementations are long and models require clean, well-structured historical data.

Aviso appeals to organizations that treat forecasting as a strategic discipline. Among Gong competitors focused on AI-driven accuracy, Aviso stands out for the depth of its modeling. The platform analyzes more than 100 variables, from CRM history and activity velocity to buyer engagement and deal movement, which gives CROs a forecast they can defend in high-stakes reviews.

Scenario modeling is its defining feature. Leaders can test best-case, expected, and downside outcomes, then watch those projections adjust as buyer engagement shifts, something most revenue intelligence tools don’t offer at this depth. This matters most in multi-region or multi-segment environments where pipeline behavior varies widely across teams.

Aviso’s risk scoring adds another layer of clarity. Managers get stronger insight into which deals are likely to slip and which rep behaviors correlate with higher win rates. These signals help guide coaching and quarterly planning more precisely.

The trade-offs appear in operations. Aviso isn’t Salesforce-native, so every insight depends on API syncs. Larger teams often report mismatches between Aviso dashboards and Salesforce fields during heavy activity cycles, which adds extra oversight for RevOps. The platform also needs clean, structured historical data to perform well, which increases onboarding time compared to lighter revenue intelligence tools.

Overall, Aviso fits enterprises with established RevOps maturity and the resources to support a complex AI forecasting engine.

Features that stand out

Aviso vs Gong: Forecast modeling and risk scoring contrasted with call-centric revenue insight.

How to Choose the Right Gong Alternatives to Fit Your Needs

Selecting a Gong alternative shouldn’t start with a feature checklist. It starts with context—your sales motion, CRM setup, adoption levels, and the hidden costs shaping your real experience. A practical evaluation framework looks like this:

1. Start with an honest assessment

The first action is looking inward. Most teams discover they use only a small fraction of Gong’s capabilities. The rest sits idle, quietly adding to renewal costs.

That realization leads to the first reaction: Do we need something simpler, or something better aligned to how we sell?

A quick pulse-check, “Would you be upset if we removed Gong tomorrow?”, often answers that faster than any usage dashboard.

2. Define non-negotiables

Once that reaction settles, the next action is identifying what truly matters. For some teams, Salesforce-native architecture is the only way to eliminate storage issues and sync delays. For others, predictable pricing, implementation speed, and forecast accuracy becomes the anchor.

As those priorities take shape, the noise around “AI,” “insights,” and “intelligence” starts to fade, because the team now knows what will actually move outcomes.

3. Match the platform to your sales motion

At this point, teams naturally shift from features to fit.

- High-velocity motions need tools that get out of the way.

- Enterprise motions need visibility across long, multi-threaded cycles.

- Hybrid motions need flexibility that won’t force reps into a rigid model.

Each insight here becomes a reaction that trims the shortlist further.

4. Run a real proof of concept

The next action is running a pilot. This is where reality pushes back against assumptions.

If reps avoid the tool during a 30–45 day trial, they won’t suddenly adopt it at rollout. That reaction reveals more than any polished demo.

5. Calculate the total cost of ownership

Finally, teams examine the part that rarely shows up on pricing pages:

- Admin time.

- Storage usage.

- Implementation effort.

- Migration risk.

- Renewal patterns.

Understanding these costs reshapes expectations, because this is where “simple tool evaluations” turn into operational decisions.

By the time teams move through these steps, the shortlist feels earned. Patterns across Gong alternatives start showing themselves, and the gaps become easier to see.

Why Sales Teams Are Moving to Revenue Grid

What happens next is almost always the same action: lining up all Gong competitors against the team’s actual needs.

The reaction is consistent across companies: every competitor to Gong is excellent at one thing, but only one.

- Clari excels at disciplined forecasting.

- ZoomInfo Chorus delivers strong call intelligence.

- People.ai shines in activity capture.

- Aviso focuses on deep AI modeling.

Each tool solves a slice of the revenue problem.

But once teams try stitching those slices together, they hit the same reaction point: too many systems, too many syncs, too many chances for something to get out of alignment.

That’s the moment teams realize they need cohesion, not another standalone module.

This is where Revenue Grid enters as the platform that closes the gaps the others leave open.

Revenue Grid ties knowledge capture, revenue signals, sales forecasting, pipeline visibility, and deal execution into a single workflow inside Salesforce. The action is simple: reps keep working where they already live.

The reaction is immediate: cleaner data, faster adoption, fewer sync issues, and pipeline reviews that actually reflect reality instead of stitched dashboards.

Once leaders see how unified signals change deal movement and forecast confidence, the final action becomes clear: they want to see it with their own data.

If you’re at that point in your evaluation, it’s worth taking a closer look.

What is Gong and what are its main limitations?

Gong is a conversation intelligence tool that analyzes sales calls and customer interactions. Its limitations show up at scale: heavy Salesforce storage usage, sync delays, and insights limited mostly to calls. Many revenue teams outgrow it and start looking for Gong competitors that cover deal intelligence, pipeline management, and coaching in one system.

Who are the top Gong competitors in 2026?

The leading Gong alternatives are Revenue Grid, Clari, ZoomInfo Chorus, People.ai, and Aviso.

- Revenue Grid for unified revenue intelligence across the entire sales process

- Clari for forecasting

- ZoomInfo Chorus for conversation intelligence

- People.ai for activity capture

- Aviso for AI modeling

How does Revenue Grid compare to Gong?

Revenue Grid goes beyond call analysis with full-funnel revenue intelligence features: activity capture, deal signals, forecasting, and coaching. It is Salesforce-native, which eliminates sync delays and data mismatches.

Teams choose it over Gong when they want clean CRM integration, stronger deal intelligence, and one platform instead of multiple tools.

Why do sales teams switch from Gong to Revenue Grid?

Sales teams switch because Gong’s total cost rises quickly: renewals, storage overages, and ops overhead. Revenue Grid replaces several tools with one Salesforce-native platform that supports sales conversations, pipeline management, and actionable insights. Adoption improves, data stays accurate, and leaders get clearer deal visibility.

How does Revenue Grid integrate with Salesforce?

Revenue Grid is fully native to Salesforce. Knowledge capture, deal intelligence features, coaching insights, and revenue signals all update in real time with no API sync layer. This strengthens CRM integration, improves rep adoption, and gives revenue leaders a complete view of the entire sales process inside one system.