Key Takeaway

- Fintech CRM failures come from missing data and lack of workflow alignment, not from missing features.

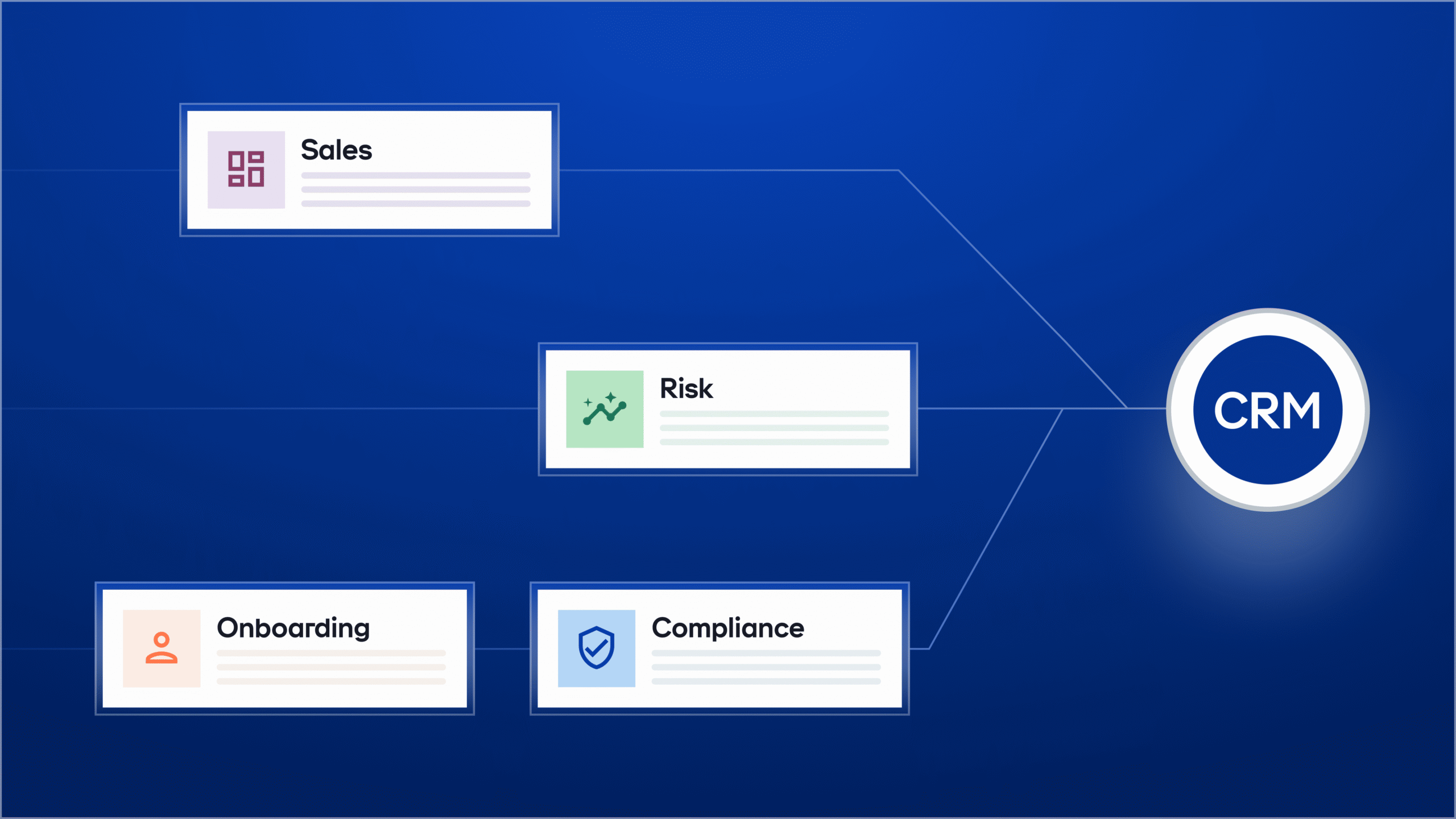

- The right CRM must support parallel tracks across sales, compliance, risk, and onboarding.

- Salesforce FSC is the strongest option for regulated fintech teams that need structure and depth.

- Microsoft Dynamics 365 works when the entire organization is already committed to the Microsoft stack.

- HubSpot fits early-stage teams but is outgrown once compliance and forecasting needs expand.

- Zoho is viable only for small, lightly regulated fintech companies.

- Oracle CX Cloud only makes sense for enterprises already invested in Oracle’s ERP and data infrastructure.

- Revenue Grid is essential for Salesforce users because it eliminates manual data entry and keeps CRM data complete and audit-ready.

Best CRM Solutions for Financial Services (At a Glance)

| If you are… | Solution |

|---|---|

| Early-stage fintech, low compliance | HubSpot or Zoho |

| Growing fintech, compliance emerging | Salesforce |

| Scaling fintech with multi-team workflows | Salesforce + Revenue Grid |

| Regulated fintech (lending, payments, wealth) | Salesforce FSC (+ Revenue Grid) |

| Enterprise banking or Oracle-native org | Oracle CX Cloud |

The most reliable CRM solutions for financial services share one principle: they minimize manual data handling while keeping all customer and deal activity fully auditable inside the system of record.

In regulated financial environments, CRM success is less about feature breadth and more about whether the platform can absorb compliance workflows, multi-team handoffs, and high interaction volume without breaking data integrity.

Modern fintech CRMs must support regulatory scrutiny, integrate cleanly with payment and KYC systems, and translate complex customer lifecycles into predictable revenue signals, without slowing teams down or creating parallel systems.

This guide examines how leading CRM approaches address these demands, why traditional CRM models struggle under fintech conditions, and what patterns distinguish systems that scale from those that quietly fail.

Why Fintech Companies Need a Different CRM Approach

At a high level, fintech teams struggle with CRM not because platforms fail outright, but because most CRMs were designed for linear sales motions. In traditional industries, revenue moves first and risk, regulation, and infrastructure follow later or live outside the CRM. Fintech does not operate with that separation.

Fintech deals move in parallel, not stages

A single fintech opportunity typically advances across multiple tracks at once. Sales discussions continue while compliance reviews run in parallel, risk teams validate exposure, and technical teams assess payment or banking integrations. Generic CRM models assume these steps happen sequentially or off-system. In fintech, they are simultaneous. When the fintech CRM solutions cannot represent parallel progress and blockers, deal stages advance on paper while unresolved risks remain invisible.

Timing errors distort revenue decisions

Data delays compound the problem. In many industries, late updates are an inconvenience. In fintech, they alter outcomes. Missed compliance interactions, unlogged stakeholder conversations, or delayed integration signals distort pipeline health and create false confidence in forecasts. By the time these gaps surface, teams are already reacting instead of steering.

Auditability is a foundation, not a feature

Security and auditability further raise the bar. CRM solutions for financial services must support detailed activity trails, role-based access controls, and region-specific retention policies from day one. These requirements shape how data must be captured and stored across the entire deal lifecycle. Retrofitting them after implementation rarely holds up under scrutiny.

Manual upkeep quietly breaks adoption

Adoption becomes the final pressure point. Fintech sales teams already operate under heavier procedural demands than most. When CRM accuracy depends on manual updates, usage erodes quietly. The system remains in place, but trust in it fades and decision-making shifts elsewhere.

Taken together, these pressures explain why fintech companies do not need more CRM features. They need a CRM designed for parallel workflows, real-time visibility, and operational precision from the start, one that reflects how fintech deals actually move, not how traditional CRM models assume they should.

Top CRM Solutions for Financial Services and Fintech Teams

We evaluated each platform based on how fintech teams use it in practice: compliance support, integration with financial systems, long-term cost, and feedback from users working with it day to day.

Quick Comparison: Best CRM for Financial Services

| Platform | Best for | Cost | Ease of use | Key trade-off |

|---|---|---|---|---|

| Salesforce Financial Services Cloud | Mid-market and enterprise fintech teams with strong compliance needs | Starts ~$325–$350/user/month + add-ons | Moderate | High total cost; requires ongoing admin support |

| Microsoft Dynamics 365 | Fintech teams already operating in the Microsoft ecosystem | ~$105–$150/user/month (Sales) + add-ons | Moderate | Fewer native fintech integrations outside Microsoft |

| HubSpot CRM | Early-stage fintech teams prioritizing speed and marketing | Free plan available; paid tiers ~$90–$150/seat/month | Easy | Limited regulatory depth as complexity grows |

| Zoho CRM | Budget-conscious early fintech teams | Starts ~$14/user/month | Easy | Weak governance and fintech-specific integrations |

| Oracle CX Cloud | Large enterprises already invested in Oracle infrastructure | Quote-based | Hard | Heavy implementation and very high TCO |

| CRM + Revenue Grid | Teams on Salesforce or Dynamics that need accurate activity capture and forecasting | Add-on pricing | Invisible to reps | Requires an existing CRM |

Comparison of top CRM solutions for financial services

We’ll start with the enterprise CRMs that most fintech teams evaluate first, then move to the platforms used by mid-market and early-stage companies. This way, you can quickly identify which category fits your current stage.

Salesforce Financial Services Cloud

Best for: Mid-market and enterprise fintech teams that need structured compliance workflows and have dedicated Salesforce admin support.

Cost: Custom pricing; rises with licenses, add-ons, and partner-led implementation.

Ease of use: Familiar Salesforce interface, but teams need training to navigate industry objects and compliance workflows.

Total cost of ownership: High, given integrations, configuration, and ongoing admin oversight.

When Salesforce Financial Services Cloud becomes relevant

Teams typically begin evaluating FSC when a standard CRM can no longer keep pace with regulated sales cycles. Early-stage workarounds: spreadsheets, ad-hoc onboarding steps, and manual compliance notes, may function temporarily, but they introduce risk as operations scale. Over time, these gaps make audits harder to predict and weaken pipeline visibility.

What FSC changes in practice

Financial Services Cloud restructures Salesforce around real financial relationships rather than generic accounts and contacts. It introduces industry-specific models such as households, beneficiaries, policies, assets, and advisory structures, allowing customer lifecycles to be represented more accurately inside the CRM.

Where FSC delivers the most value

Salesforce FSC’s strength lies in depth and ecosystem alignment. It integrates natively with payment platforms like Stripe and Adyen, KYC providers such as Jumio and Onfido, and core banking systems. For teams managing sales, compliance, and risk in parallel, this reduces operational fragmentation. Einstein AI builds on this foundation by supporting forecasting and deal insights as data quality stabilizes. FSC also supports audit trails, retention policies, consent tracking, and regulatory expectations tied to SEC, FINRA, and GDPR requirements.

Trade-offs to consider

The same depth that makes FSC powerful also makes it heavy. Ongoing admin support is required to maintain custom objects and workflows, and costs scale quickly with additional licenses, consulting hours, API usage, and storage. In practice, a per-user license of $150–$300 can translate into a six-figure annual investment.

Verdict

For organizations that need strong structure and regulatory alignment, Salesforce FSC is one of the most capable options available. Its effectiveness, however, still depends on clean and complete data. Without reliable activity capture, forecasting accuracy and compliance visibility degrade over time.

Want a deeper breakdown?

Looking for a deeper breakdown of how financial institutions handle security, accessibility, and workflow

challenges inside Salesforce?

Revenue Grid, in collaboration with Salesforce, created a detailed Financial Sector Ebook

that covers secure email and calendar integration, Lightning Scheduler limitations, data silos,

and cross-team visibility requirements for regulated organizations.

Download the Financial Sector Ebook

For companies already invested in Microsoft infrastructure, Microsoft Dynamics 365 becomes the natural alternative.

Microsoft Dynamics 365

Best for: Fintech companies already committed to the Microsoft ecosystem (Azure, Outlook, Teams, Power BI) and looking for a unified operational stack.

Cost: Mix of modular licenses; total spend scales with add-ons, custom integrations, and partner-led implementation.

Ease of use: Familiar for Microsoft-heavy teams, but still requires onboarding to handle CRM configuration and workflow setup.

Total cost of ownership: High if you need integrations outside the Microsoft ecosystem.

Where Dynamics 365 fits well

Dynamics 365 tends to make sense when Microsoft tools already anchor daily work. Revenue teams operating primarily in Outlook and Teams benefit from tighter workflow continuity, with emails syncing reliably, call notes flowing through Teams, and reporting handled through Power BI without heavy BI engineering. For Microsoft-first organizations, this creates a connected experience with minimal context switching.

On the infrastructure side, Azure provides enterprise-grade security and a broad set of compliance certifications relevant to fintech teams. Dynamics also integrates closely with Microsoft’s Finance and Operations modules, which is useful for organizations managing multi-entity reporting, billing complexity, or cross-department financial workflows. Copilot adds task-level automation, supporting activities like email drafting, record summarization, and routine data entry.

Where trade-offs appear

Limitations emerge when fintech-specific integrations are required. Compared to Salesforce, the Microsoft marketplace is smaller, with fewer native connectors for payment processors, KYC providers, and core banking systems. Integrations outside the Microsoft ecosystem often require custom development, increasing implementation time, cost, and partner dependency. Teams also note that the interface prioritizes functionality over intuitiveness, which can slow adoption if users are not already deeply embedded in Microsoft tools.

Verdict

Dynamics 365 is a strong option for Microsoft-first fintech organizations seeking operational continuity across teams. For earlier-stage companies or teams looking for lighter setup and faster iteration, alternative CRM approaches are often explored—most commonly platforms like HubSpot.

HubSpot CRM

Best for: Early-stage fintech teams (under ~$20M revenue) that need a simple, fast CRM with strong marketing automation.

Cost: Free plan available; paid tiers run up to ~$150/user/month.

Ease of use: Intuitive for new users; onboarding is minimal.

Total cost of ownership: Low at the start, with costs rising as complexity grows.

Where HubSpot fits well

HubSpot is often chosen when fintech teams need to deploy a CRM quickly without the overhead of complex configuration. Among early-stage CRM solutions for financial services, it stands out for fast setup, high user adoption, and low operational friction. Most sales and marketing users can become productive within days, which is critical during early growth.

For U.S.-based, B2C-led fintech models, such as payments, neobanking, or consumer lending, HubSpot’s native marketing automation is a strong advantage. Email campaigns, forms, customer journeys, and behavioral tracking live in one platform, enabling tighter coordination between marketing and revenue teams during expansion.

The free tier also plays a strategic role. It allows founders to establish core pipelines and reporting before committing to paid plans, reducing early risk while validating sales motion and customer acquisition channels.

Where limitations emerge

As fintech operations mature, HubSpot’s limitations become more visible. Advanced workflows, compliance documentation, audit-ready reporting, and role-based controls often require higher-tier plans. Even then, HubSpot lacks the depth expected from more mature fintech CRM solutions, particularly for companies operating under U.S. regulatory frameworks such as SEC, FINRA, or state-level financial oversight.

While HubSpot supports baseline GDPR and data privacy requirements, it does not offer the same level of audit trails, retention policies, or governance controls required by regulated U.S. financial institutions.

A common inflection point appears around Series B. As compliance, integrations, and forecasting complexity increase, many fintech companies migrate from HubSpot to Salesforce. That transition can be costly, making early CRM architecture decisions more consequential than they initially appear.

Verdict

HubSpot delivers speed, simplicity, and strong marketing alignment for early-stage U.S. fintech teams. As regulatory and operational complexity increases, costs rise and long-term fit becomes more limited compared to enterprise-grade CRM solutions for financial services.

For teams seeking an even leaner entry point before HubSpot, Zoho is often evaluated next.

Zoho CRM

Best for: Budget-conscious early-stage fintech teams (under ~$10M revenue) with small sales teams and lighter regulatory demands.

Cost: ~$14–$52/user/month.

Ease of use: Simple enough for new teams, with a drag-and-drop Canvas builder for light customization.

Total cost of ownership: Low, especially for teams using multiple Zoho apps.

Where Zoho fits well

Zoho typically enters consideration when fintech teams need a functional CRM without the cost or operational overhead of larger platforms. For pre-seed or seed-stage companies operating in lightly regulated segments, Zoho offers a broad feature set at a price point that is difficult to ignore. Lead management, basic automation, reporting, and Zia AI are available at tiers where other CRM solutions for financial services often reserve similar capabilities for higher-priced plans.

The broader Zoho ecosystem is another advantage for small teams. Tools like Zoho Books, Zoho Desk, and Zoho Analytics create a reasonably unified operating environment. When sales workflows are simple and compliance is not central to daily execution, Zoho can support early traction without adding administrative burden.

Where limitations appear

As fintech operations grow, Zoho’s constraints become more apparent. Reviews consistently highlight gaps in enterprise readiness, and for financial services use cases, regulatory depth is the most common limitation. Zoho does not provide the audit controls, retention management, or governance features expected by U.S. fintech companies operating under SEC, FINRA, SOX, or state-level regulatory frameworks.

Native integrations with fintech infrastructure are also limited. Connections to payment processors, banking cores, and KYC providers are sparse compared to more established fintech CRMs, often requiring custom workarounds. As deal complexity increases, teams may encounter friction with reporting, automation logic, and audit preparedness.

Verdict

Zoho works well when you’re early, scrappy, and operating in a lightly regulated segment of fintech. It helps keep costs under control while you validate your model. However, most companies outgrow it as compliance requirements deepen.

At the other end of the spectrum sits Oracle, a platform built for large enterprises already committed to Oracle’s ecosystem.

Oracle CX Cloud

Best for: Large enterprise fintech companies (>$500M revenue) already running on Oracle ERP, databases, or core financial systems.

Cost: Custom; typically $200–$400/user/month.

Ease of use: Powerful but dated; teams face a learning curve.

Total cost of ownership: Highest on this list due to specialist-led implementations and heavy customization.

Where Oracle CX Cloud fits well

Oracle CX Cloud is usually considered when a fintech organization is already deeply invested in Oracle’s ecosystem. For enterprises managing massive datasets, complex financial models, or multi-region reporting, Oracle’s strength in data management and system performance becomes a meaningful advantage. Tight integration with Oracle ERP and finance modules supports tightly coupled ERP–CRM workflows that are difficult to replicate elsewhere.

Security and compliance are also core strengths. Oracle’s architecture is designed to meet stringent regulatory and governance requirements, which is critical for large organizations operating across banking, lending, payments, or global financial services. For teams that need governance controls embedded across every system, Oracle provides that rigor by default.

Where trade-offs become significant

The challenges with Oracle CX Cloud surface early in implementation. Deployments are consistently described as complex and slow, often requiring Oracle-certified specialists to configure, customize, and maintain the system. Compared to newer CRM solutions for financial services, the interface feels dated, and making changes to workflows, objects, or integrations requires substantial effort.

These factors drive long-term cost. Many enterprises report seven-figure implementation budgets, followed by ongoing expenses tied to customization, maintenance, and specialist support. For fast-moving fintech teams, this operational weight can slow iteration and reduce agility.

Verdict

Oracle CX Cloud makes sense only if your organization is deeply invested in Oracle infrastructure and needs tightly coupled ERP–CRM workflows. For most fintech companies, even large enterprises, Salesforce Financial Services Cloud (Salesforce FSC) delivers more relevant industry features with far less complexity.

At this point, the real question shifts from comparing features to understanding what actually fits your operating model.

How to Choose the Best CRM for Your Financial Services

Choosing the right CRM starts with understanding the work your organization performs every day. Fintech sales cycles are fast, multi-threaded, and compliance-heavy, so the system you choose has to support that reality without slowing teams down.

Four criteria consistently determine whether a CRM will hold up once you scale:

- Integration depth

Your CRM should connect cleanly to your payments stack, KYC tools, banking core, and onboarding systems. If every connection requires middleware and consultants, you’ll feel the friction within months. - Support for parallel workflows

Fintech deals don’t move one stage at a time. If your CRM hides blockers instead of surfacing them across teams, your pipeline will always look healthier on paper than in reality. Look for a system that can display activity from every team, including sales, compliance, risk, and onboarding, in one place. - Data automation

This is the quiet deal-breaker. If your CRM relies on reps to log emails, calls, meetings, and approvals, the data will decay fast.

That’s why fintech teams using Salesforce almost always add Revenue Grid for revenue operations. It removes manual entry, keeps records accurate, and gives you the audit-ready activity trail regulators expect.

Watch how Revenue Grid reveals insights into deal health

See how Revenue Grid surfaces real-time signals and activity insights to help teams

understand deal risk, momentum, and forecast confidence.

- Long-term cost

Subscription pricing is misleading. What matters is the three-year commitment: licenses, add-ons, admin workload, integrations, and the cost of switching if you outgrow the platform.

Match your CRM to your operational stage

| Stage | Team size | What shifts | What actually works |

|---|---|---|---|

| Early (<$10M, simple motion) | < 20 reps | Need speed and basic structure | HubSpot or Zoho |

| Growing ($10M–$100M) | 20–100 reps | Compliance enters the picture | HubSpot Pro or Salesforce |

| Scaling ($100M–$500M) | 100–300 reps | Sales forecasting and multi-team workflows | Salesforce + Revenue Grid |

| Enterprise ($500M+) | 300+ reps | Governance and multi-entity complexity | Salesforce FSC + Revenue Grid |

Note: A CRM only works if it contains accurate data.

This is the pivot point, because accuracy is important for revenue forecasting. Which brings us to the next piece of the puzzle: if Salesforce is your core CRM, how do you make sure it actually runs on complete, trustworthy data?

Maximize Your Salesforce Investment with Revenue Grid

Salesforce can support the pace and complexity of fintech operations, but it stays reliable only when daily activity is captured with consistency. In most teams, that’s where the system starts to drift. Activity moves faster than documentation, and the CRM gradually loses alignment with what is happening in real conversations, reviews, and approvals.

Revenue Grid addresses this at the source. It records the work already happening across your organization: emails, meetings, calls, and follow-ups, and writes it into Salesforce automatically. The CRM simply remains accurate because nothing depends on manual updates.

Here’s what Revenue Grid solves for a fintech company:

| Challenge in daily workflow | How Revenue Grid resolves it |

|---|---|

| Hours spent logging emails, meetings, and follow-ups | Automatically captures emails and calendar activity from Outlook and Gmail, removing manual entry |

| Gaps in engagement history and audit trails | Pulls relevant interactions into Salesforce consistently, improving traceability |

| Pipeline updates based on assumptions | Grounds deal movement in real engagement signals rather than subjective updates |

| Complex Salesforce environments | Lets teams act directly from their inbox instead of navigating multiple Salesforce screens |

| Data ownership and governance concerns | Keeps activity data inside Salesforce through a native architecture |

Rather than functioning as an additional platform, Revenue Grid acts as a stability layer around your existing fintech CRM. The teams continue working from their inboxes. Salesforce receives the details it needs.

What You Gain with Revenue Grid

Teams typically notice improvements in areas that shape both revenue and compliance:

- Activity Capture: Emails and calendar events are logged automatically. Supported call activities can also be captured through integrations. No manual data entry required.

- Pipeline Visibility: Engagement-based signals highlight deal momentum, stalled opportunities, and early signs of revenue leakage before deals quietly decay.

- Guidance: Deal-level guidance, AI-powered meeting prep, guided selling recommendations, and coaching insights for managers.

- Salesforce-Native: Data remains inside Salesforce, supporting governance, auditability, and existing workflows, which is critical for regulated fintech environments.

Teams evaluating the best CRM for financial services workflows often compare Revenue Grid with Einstein Activity Capture. The distinction usually centres on two factors: depth of capture and control of data. Revenue Grid keeps everything within Salesforce, adapts cleanly to multi-step sales motions, and maintains full traceability for regulated workflows.

The outcome is simple: Salesforce stays accurate without turning data entry into a task that slows your teams down.

If strengthening data quality is your priority this quarter, a short demo can help you understand how Revenue Grid fits into your current Salesforce setup.

How much does fintech CRM implementation really cost?

Licensing is the part everyone sees. Implementation is the part that determines the real budget. For enterprise fintech teams, these are the typical ranges:

- Salesforce Financial Services Cloud:

$150–$300 per user each month, plus $150K–$500K a year for implementation, customisation, training, integrations, and ongoing admin support. - HubSpot Enterprise:

~$150 per user each month, with $20K–$50K in implementation. Total cost stays lower early on, but migration becomes a meaningful expense once you outgrow the platform.

As a rule of thumb, expect your true cost to land at two to three times the annual licensing once configuration, integration, and internal resources are factored in.

What's the biggest mistake fintech companies make with CRM?

Fintech companies assume reps will keep the system updated. However, in reality, teams already juggle compliance, risk checks, and stakeholder coordination, so manual data entry drops fast. The CRM stays in place, but the data stops reflecting reality. Most failures come from relying on humans instead of automating activity capture.

How do fintech CRMs integrate with existing systems?

A fintech CRM integrates with core systems through APIs, native connectors, and secure middleware. The strongest platforms connect cleanly to payment processors, KYC/AML tools, onboarding systems, customer data platforms, and core banking infrastructure. For financial services teams, the integration must also support audit trails, data lineage, and permission controls so information stays accurate across every workflow.

How can a CRM improve my fintech company’s customer engagement?

A well-implemented fintech CRM gives every team a shared view of customer activity across sales, onboarding, service, and compliance. This reduces blind spots and helps teams respond faster. Automatic activity capture keeps histories complete, and engagement signals highlight where conversations are slowing down. For financial services organizations, this translates into stronger retention, smoother onboarding, and more consistent customer experiences.

What features should I prioritize in a fintech CRM?

Financial services teams should focus on four areas that determine long-term reliability:

- Integration depth with payments, KYC/AML systems, and banking infrastructure

- Support for parallel workflows across sales, compliance, risk, and onboarding

- Automated activity capture to prevent incomplete data

- Governance and compliance controls, including role-based access, retention policies, and audit trails

These foundational capabilities matter more than any surface-level feature list.

Are there any specific compliance considerations for fintech CRMs?

Yes. A CRM for financial services must maintain complete activity histories, enforce role-based access, support data retention policies, and provide transparent audit trails. It also needs to manage sensitive financial data within controlled environments and align with regulations such as SEC, FINRA, SOX, GDPR, and other regional compliance frameworks. These requirements often influence which fintech CRM platforms are viable for scaling.