Key Takeaway

- Salesforce Financial Services Cloud models financial relationships as connected households, accounts, and lifecycle events rather than isolated CRM records

- This structure reduces reliance on manual context, individual memory, and disconnected systems as client relationships grow

- Even with strong CRM foundations, deal momentum and engagement shifts often remain invisible between updates

- Revenue intelligence surfaces activity signals from email and meetings to reveal risk, momentum, and forecast changes earlier

- Combining Salesforce FSC with revenue intelligence helps financial services teams make confident revenue decisions with fewer surprises

Financial services relationships don’t stay simple for long.

What starts as a single client often grows into a household. Accounts multiply. Beneficiaries change. Advisors rotate. Compliance enters the picture. Years pass, and the relationship keeps evolving.

Salesforce Financial Services Cloud (FSC) is built for this reality.

Instead of treating contacts, accounts, and opportunities as isolated records, FSC structures financial relationships as connected entities. Households, accounts, beneficiaries, and lifecycle events live together in one governed system, giving teams shared context rather than fragmented views.

That structure matters, but structure alone doesn’t guarantee clarity.

This guide explains how Salesforce Financial Services Cloud organizes financial work, where visibility gaps still emerge, and how revenue intelligence helps teams understand what’s actually happening inside long, relationship-driven deals.

How Salesforce Financial Services Cloud Organizes Financial Work

A typical financial services relationship involves more than a single contact or account.

Over time, a client relationship may expand to include a household, multiple accounts, beneficiaries, advisors, and compliance requirements. That context evolves gradually, often across years, and rarely fits neatly into isolated CRM records.

In many organizations, this information ends up scattered. Some of it lives in CRM notes, some in spreadsheets, some in email threads, and some in the advisor’s own memory. Before meaningful work can begin, teams spend time reconstructing the relationship.

Salesforce Financial Services Cloud is designed to remove that friction.

Instead of treating each contact or opportunity as a standalone object, FSC models financial relationships as connected structures. Households, accounts, policies, beneficiaries, and advisors are linked by design, giving teams a complete view of the relationship in one place.

For an advisor preparing for a quarterly review, this means opening a single household record and seeing all related accounts, policies, recent activity, and lifecycle events together. There is no need to cross-reference systems or manually piece together context before the conversation starts.

This structure also changes how work continues after the meeting.

Service requests raised during a review are logged against the household. Follow-up tasks are visible to service teams. Compliance reviews tied to account changes are triggered and tracked within the same record. Each team works from shared context rather than passing information through emails or informal handoffs.

For leadership, this reduces operational risk in subtle but important ways. Teams rely less on individual memory, fewer workarounds emerge, and complex relationships can be managed consistently as volumes grow.

This structured foundation is what allows Salesforce Financial Services Cloud to scale across long-lived client relationships. To understand why it holds up over time, and where its limits begin, it’s important to look at how FSC structures data underneath.

Understanding the FSC Data Model

Client relationships in financial services rarely end with a single interaction.

A beneficiary update may happen weeks later. A compliance review follows. Another advisor engages the same household months down the line. Leadership reviews the relationship long after the original conversation.

Over time, this is where CRM confidence often erodes.

Where Context Breaks Down

As updates accumulate, records become harder to interpret. Notes lose relevance outside the moment they were written. Tasks and decisions become difficult to trace back to their origin.

Teams inherit data, but not understanding.

How FSC Preserves Continuity

Salesforce Financial Services Cloud is designed to prevent that erosion.

Its data model keeps households, accounts, and lifecycle events connected by design. A beneficiary change stays tied to the correct account, which rolls up to the household. Service tasks and compliance reviews remain linked to the same relationship over time.

When someone revisits the record, they see how the relationship evolved, not just its current state.

What the Data Model Solves and What It Doesn’t

This structure protects against context decay. Reporting remains reliable. Segmentation holds as roles change. Leadership can trust what they see without reconstructing history.

However, structure alone does not capture momentum.

Client engagement continues through emails, meetings, and informal conversations. A relationship can slow down or lose energy without a single Salesforce field changing. FSC preserves structure and history, but it does not interpret what is happening between updates.

Let’s look at some common challenges faced by financial services teams.

Common Challenges Financial Services Teams Face

Salesforce Financial Services Cloud solves many structural problems. Yet even with a strong foundation in place, teams still encounter uncertainty in day-to-day execution.

That tension shows up in a few predictable ways.

Pipeline Confidence Gaps

On paper, deals often appear stable.

Opportunities remain open. Stages stay unchanged. Required fields are complete. Dashboards suggest progress. But underneath, momentum can fade quietly.

Key stakeholders disengage. Meetings become less frequent. Follow-ups stretch out. None of this necessarily triggers a visible change in Salesforce, so risk remains hidden until forecasts shift late or deals slip entirely.

By the time the issue becomes visible, options are limited.

Manual CRM Updates Don’t Scale

Financial services work does not happen inside fields and forms.

It happens across conversations, emails, meetings, calls, and informal check-ins. Expecting advisors or relationship managers to manually log every meaningful interaction does not scale, especially when their priority is client engagement, not system upkeep.

As a result, activity lives outside the CRM. Records stay structured, but incomplete. Context exists, just not where leaders look when making decisions.

Structure Without Interpretation

These challenges don’t suggest that Salesforce Financial Services Cloud is falling short. In fact, FSC is doing exactly what it was designed to do: preserving structure, consistency, and historical accuracy across complex relationships.

What it does not attempt to do is interpret behavior.

Salesforce can show what exists in the system. It cannot explain why engagement is slowing, which relationships are cooling, or where attention is needed before outcomes change. That insight lives in daily activity, not static records.

This is where many teams feel the difference between having data and being able to act on it in time.

Why Financial Services Teams Add Revenue Intelligence on Top of Salesforce FSC

Salesforce Financial Services Cloud provides structure.

Relationships are modeled correctly. Data is governed. Records stay consistent over time. For most financial services teams, FSC becomes the system they trust to hold client history.

What it doesn’t do is explain momentum.

In long, relationship-driven deals, opportunities rarely collapse overnight. Engagement slows. Conversations thin out. Decisions stretch. None of this requires a stage change, so the risk often stays invisible inside Salesforce.

Revenue intelligence fills that gap.

What Revenue Intelligence Adds to FSC

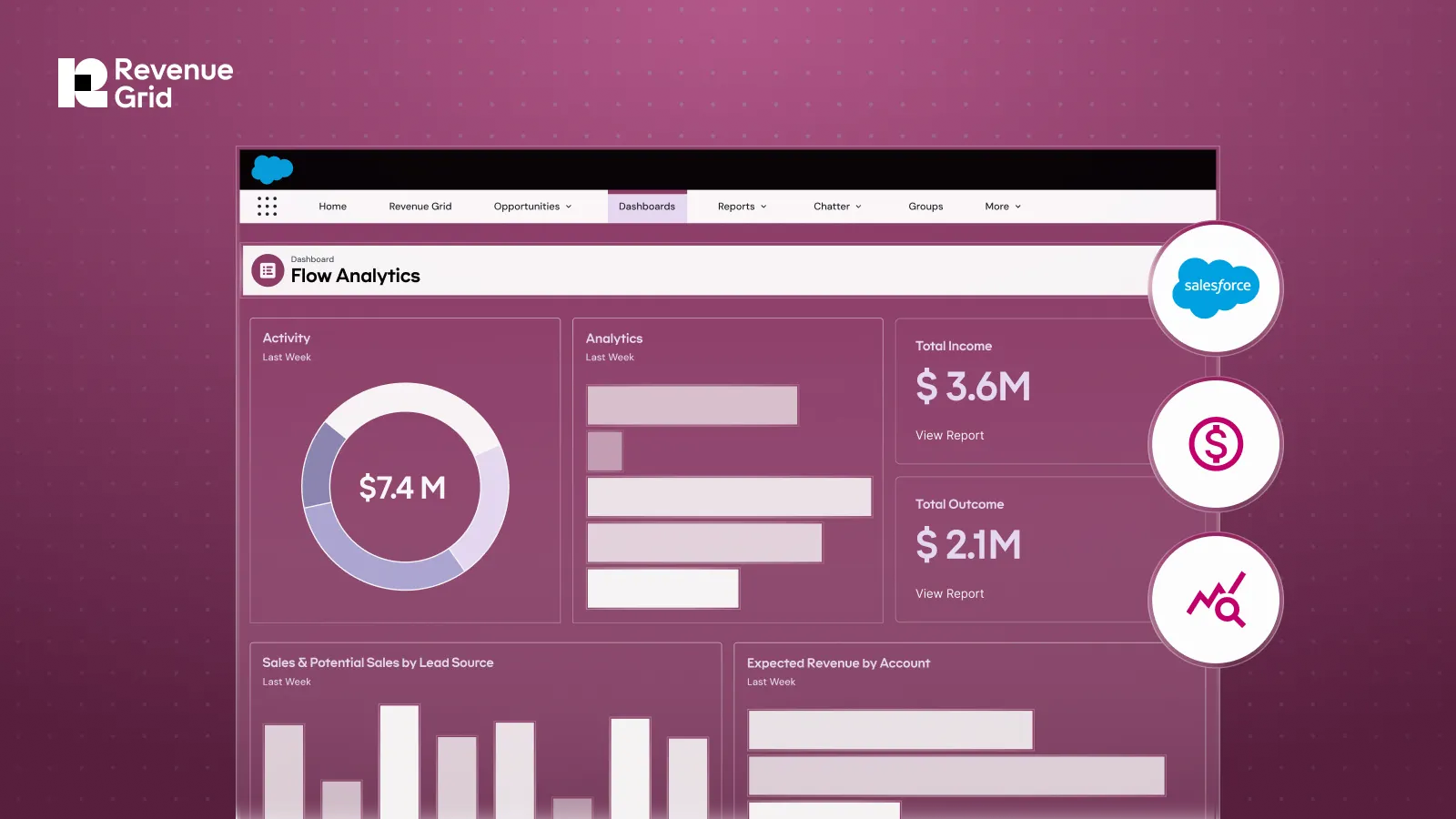

RevenueGrid makes relationship activity visible without adding work for advisors or managers:

- Automatically captures emails, meetings, and tasks and reflects them in Salesforce

- Surfaces engagement trends directly in the pipeline, not buried in activity logs

- Highlights which opportunities are progressing and which need attention

- Connects forecast changes to observable activity, not last-minute judgment calls

How This Changes Day-to-Day Decision-Making

With this layer in place, teams stop relying on assumptions:

- Leaders see risk earlier, while there is still time to act

- Forecast changes become explainable instead of reactive

- Advisors know where to focus follow-ups before momentum is lost

All of this insight appears where teams already work, inside Salesforce and the inbox sidebar, without switching systems or breaking workflow.

Salesforce Financial Services Cloud provides structure and governance. RevenueGrid adds interpretation, helping teams understand how relationships are actually evolving and where attention is needed next.

Clarity Comes After Structure

Salesforce Financial Services Cloud gives financial services teams the structure they need to manage complex, long-lived client relationships. Households, accounts, workflows, and compliance processes are organized in a way that scales as relationships grow.

What determines outcomes, however, is not structure alone.

Deals move forward or stall based on real interactions. Engagement shifts before fields change. Momentum fades long before a forecast is adjusted. Without visibility into those signals, even well-structured pipelines can produce late surprises.

Revenue intelligence adds that missing layer of clarity. By interpreting activity already happening across email and meetings, it helps teams understand which relationships are advancing, where attention is needed, and why forecasts change over time.

For organizations that already rely on Salesforce Financial Services Cloud as their system of record, the next step isn’t more configuration. It’s insight.

See how RevenueGrid helps financial services teams move from structured CRM data to confident revenue decisions.

What are the first steps to implementing Salesforce Financial Services Cloud?

Start by defining core client workflows and relationship structures. Clean existing data before migration and focus on a strong foundation before expanding use cases.

How does Salesforce Financial Services Cloud support security and compliance?

FSC includes role-based access controls, audit trails, and permissioning aligned to financial services roles, supporting regulated environments without heavy customization.

What systems does Salesforce Financial Services Cloud integrate with?

FSC integrates with core banking systems, policy administration platforms, data warehouses, and reporting tools, allowing Salesforce to function as a central operating layer.

How does Salesforce Financial Services Cloud improve client engagement?

By organizing households, accounts, and relationship history in one place, FSC gives advisors full context before interactions and supports smoother handoffs across teams.

Where does revenue intelligence fit into a Salesforce FSC setup?

FSC structures client data and workflows. Revenue intelligence interprets activity such as meetings and communication patterns to surface momentum, risk, and forecast drivers.

How long does it take to see value from Salesforce Financial Services Cloud?

Teams often see foundational value shortly after go-live. Deeper impact depends on adoption, data quality, and how well Salesforce is embedded into daily work.